How to Value a Childcare Center in Florida

When it comes to selling or buying a childcare center in Florida, understanding how to determine its true value is critical. Unlike other industries, childcare centers come with a unique blend of financial, regulatory, and emotional considerations. This guide walks you through the key drivers, valuation benchmarks, and essential factors that influence pricing in this dynamic market.

Why Valuing a Daycare Business is Different

Childcare centers are more than just businesses; they are deeply rooted in community trust and overly sensitive to staffing, enrollment, and compliance with state and federal regulations. Buyers are not only acquiring financial performance but also intangible assets like reputation, staff stability, and licensing. This combination makes proper valuation both an art and a science.

1. Key Drivers of Value in Florida Childcare Centers

-

1Enrollment and Capacity Utilization Operating at or above 80% enrollment is often the benchmark for healthy performance. Centers that consistently hit full or near-full capacity command higher multiples.

-

2Licensing and Compliance Fully licensed centers with a clean inspection history are valued more favorably. Centers participating in state voucher programs or the USDA food program may attract broader buyer pools.

-

3Real Estate Ownership vs. Lease If the center includes real estate, it opens the door for longer-term SBA financing and can significantly increase the overall transaction size. While long-term leases (15 years or more) are also attractive, real estate ownership adds an extra layer of security and financing flexibility for buyers.

-

4Staff and Management Structure A director in place, rather than the owner being heavily involved, add value by reducing buyer risk. Low teacher turnover and proper staff certifications contribute to long-term sustainability.

-

5Financial Records Clean bookkeeping, accurate enrollment reports, and verifiable profit margins are essential. Strong EBITDA or SDE performance with upward trends can drive significant buyer interest.

-

5Accreditation and Credentials Credentials such as APPLE accreditation, Gold Seal Quality Care status, or membership in the National Association for the Education of Young Children (NAEYC) can significantly increase marketability and perceived value.

2. What Are the Valuation Multiples?

| Type of Center | Typical Multiple |

|---|---|

| Owner-Operator, fewer than 40 children | 2.0x - 2.5x SDE |

| Licensed for 75-120, Director in Place | 3.5x - 4.5x SDE |

| Multi-Center Portfolio (No Real Estate) | 5.0x - 7.0x EBITDA |

| With Real Estate (Turnkey) | Asset-based + 4x - 6x SDE |

Pro Tip: Institutional buyers and private equity groups are actively targeting large, scalable daycare operations in Florida. These buyers often pay a premium for multi-location networks with strong infrastructure.

In some instances, particularly when real estate is included, childcare centers in Florida have sold for $10,000 to $18,000 per licensed child. It’s important to assess whether the property’s market value is aligned with its best use as a childcare facility. If not, a blended approach that considers license capacity, profitability, and real estate value is often used. The financials must support mortgage obligations, operating costs, and reasonable compensation for the buyer.

3. Florida-Specific Financial Benchmarks

- Occupancy Costs: 12% to 16.5% of revenue

- Labor Costs: 55% to 65%

- Net Profit Margin (Pre-Tax): 15% to 18%

- Revenue per Employee: Approximately $50,000

High-performing centers in Florida typically combine full enrollment with efficient management of wages and overhead.

4. Legal and Regulatory Considerations in Florida

In Florida, childcare centers must be licensed through the Department of Children and Families (DCF). Regular inspections, background checks, and staff training are mandatory. A poor inspection history or compliance issues can significantly impact value.

The state also enforces teacher-to-child ratios, CPR and First Aid certification, and facility requirements. These regulations are important considerations for buyers during due diligence.

5. Trends Affecting Valuation in 2025

- Increased Demand: More parents returning to in-person work has led to higher demand, especially in residential areas.

- Labor Challenges: Rising wages continue to put pressure on margins but also limit competition, benefiting centers with strong operations.

- Expanded Subsidies: State programs and government vouchers help maintain occupancy rates and steady cash flow.

6. Key Due Diligence Considerations for Buyers

This is not an exhaustive list, but here are some of the more important items to review:

- Financial reports, including P&Ls, tax returns, and QuickBooks files Enrollment data, preferably tracked weekly for at least the past year Staff credentials, employment history, and turnover Copies of licenses, inspections, and DCF compliance reports USDA food program documentation, if applicable Lease agreements and zoning compliance Accreditation certificates such as APPLE or NAEYC

7. Red Flags That Can Lower Value

- Heavy reliance on the owner, particularly in the classroom or as the director Inconsistent or poorly documented financials High turnover among teachers Month-to-month leases or lack of lease security Regulatory violations or unresolved compliance issues

8. Factors That Increase Marketability

- Positive parent reviews and community reputation Low attrition and consistent enrollment levels Strong educational programming and curriculum Clean, modern facilities and organized operations Accredited status and professional management

Case Study: Prior Childcare Business Sold in Florida

A childcare business I previously sold was in a highly desirable Florida neighborhood. It was licensed for 170 children, with facility plans that allowed for future expansion to double its license capacity. The transaction closed as an all-cash deal for nearly $3 million. The center’s value was supported by strong enrollment, profitability, real estate ownership, and an experienced director. Its APPLE accreditation and compliance record played a key role in attracting serious buyers and securing the purchase.

Final Thoughts

If you’re planning to sell a childcare center, begin preparing at least six to twelve months in advance. Improve operational consistency, document your processes, and clean up financial records. For buyers, collaborating with an advisor who understands both childcare licensing and business valuation is crucial.

At Transworld Business Advisors, we help sellers and buyers of Florida childcare centers make well-informed decisions. Whether you’re considering selling or actively looking to purchase, we’re here to guide you every step of the way.

Interested in finding out what your childcare business is worth?

Author: Aniss Cherkaoui P.A., M&A Advisor — Transworld Business Advisors

Related Articles

- How to Value a Mental Health Clinic in Florida

- How to Value an Electrical Company in South Florida

- Business Valuation Calculator - Real Comps & Florida Broker Support

Sources: Industry statistics and trends are referenced from IBISWorld and DealStats. These sources are cited for informational purposes to support business planning and valuation insights. Visit www.ibisworld.com and www.bvresources.com for more information.

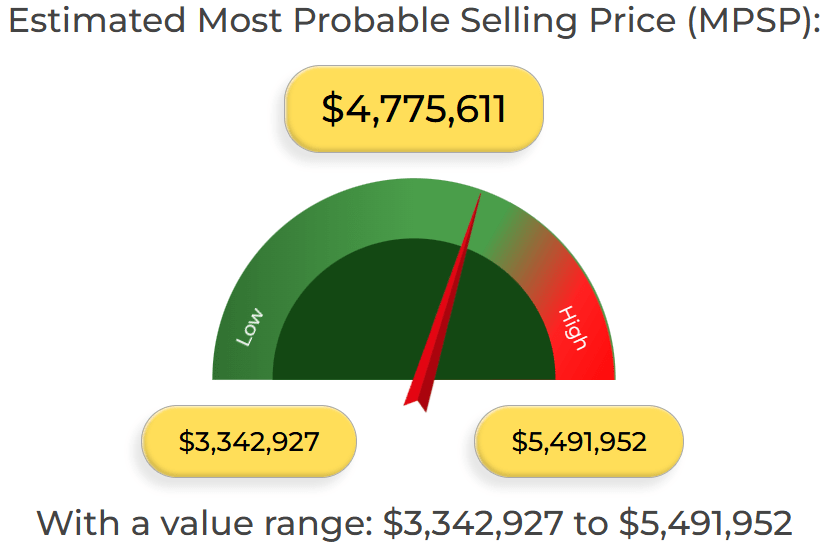

Free Business Valuation Calculator Results

Get an accurate, data-backed valuation estimate in seconds. This is a sample of the valuation range you’ll see after using our calculator:

Why Business Owners Trust my Calculator:

-

1Instant Business Valuation Range No waiting get your estimated business value right away.

-

2Data-Driven Accuracy Calculations are based on thousands of real private business sales and market insights.

-

3Built for Owners Ready to Sell Whether you’re planning an exit, seeking investors, or just curious, this tool gives you a realistic snapshot of your business’s current value.

Call Today to Speak with a Broker 305-608-6761

You might want to see

Business Valuation Calculator - Real Comps & Florida Broker Support (MPSP Alternative to CalcXML)

How to Value an Electrical Company in South Florida