Expert Guidance to Value and Sell Your Florida Business

Clear, practical insights for Florida business owners—covering valuation, preparing for a sale, buyer expectations, and local market trends. Every article is based on real transaction experience and written to help you make informed decisions.

This blog is designed to give Florida business owners straightforward, practical guidance supported by real transaction experience on business valuation, exit planning, marketability, buyer expectations, and the selling process. Whether you're in Miami, Broward, Palm Beach, or anywhere in Florida, these articles will help you prepare for a successful and well-planned exit.

Aug

How to Calculate Seller’s Discretionary Earnings (SDE) And Why It Can Make or Break Your Business Sale

Aug

Selling Without a Broker: Smart Move or Expensive Mistake?

Aug

Do You Really Need a Lawyer to Sell Your Business?

Aug

10 Mistakes to Avoid When Selling Your Small Business

Aug

How to Make Your Business Highly Sellable in Fort Lauderdale: Expert Advice by Aniss Cherkaoui P.A.

Jun

How to Value a Landscaping Business in Florida | Market-Based Guide + Insider Tips

Jun

Top Business Broker in Florida | Tips + Market Insights

Jun

How to Value an Engineering Firm in Florida (Civil, Structural & Beyond)

Jun

How to Value a Childcare Center in Florida

Jun

How to Value a Mental Health Clinic in Florida

Jun

Business Valuation Calculator - Real Comps & Florida Broker Support (MPSP Alternative to CalcXML)

Jun

How to Value an Electrical Company in South Florida

If you own an electrical company in South Florida and are thinking about selling, planning for retirement, or simply want a clearer picture of your company’s worth, knowing your valuation is the first critical step. The right insight can unlock better decisions, stronger outcomes, and a more profitable exit.

Jun

How to Value a Roofing Company in Florida

Jun

How to Value an HVAC Company in Florida

May

How to Increase the Value of Your Business Before You Sell

Selling your business is one of the most important decisions you’ll make as an entrepreneur. For many owners, it’s the final chapter in a journey that took years of hard work, personal sacrifice, and long-term vision. And yet, far too many business owners wait until they’re ready to sell before they think about how to maximize their company’s value. The truth is that the best time to prepare your business for sale is well before you ever list it.

As a seasoned business broker who’s worked with hundreds of Florida business owners, I’ve seen firsthand what buyers look for and what turns them away. If you want to get a top dollar for your company, you need to think like a buyer. That means creating a business that is not just profitable, but also stable, transferable, and built for growth.

Below are seven proven strategies you can begin applying now to make your business more attractive, more valuable, and ultimately more sellable.

1. Get Your Financials in Shape and Make Them Easy to Understand

When a buyer expresses interest in your business, the very first place they’ll look is your financials. That includes profit and loss statements, balance sheets, and tax returns; typically for the last three years. Buyers and lenders alike want to understand not just how much money the business makes, but how predictable and reliable that income is.

For many small businesses, some personal expenses may have been run through the company over the years. However, when preparing for a sale, these co-mingled expenses can make it harder for a buyer to understand your true cash flow.

You don’t need to eliminate everything overnight, but you do want to start cleaning things up. Make note of any discretionary or personal expenses so they can be properly documented as "add-backs" during the valuation and negotiation process. Better yet, begin the habit of keeping personal and business transactions separate moving forward.

Also, consider asking your CPA or bookkeeper to organize your financials with an eye toward clarity and simplicity. The easier it is for a buyer to see the profitability of your business, the more likely they are to make a strong, confident offer.

2. Build Systems and Processes That Run Without You

One of the biggest concerns a buyer will have is what happens to the business after the owner leaves. If your company relies entirely on your daily involvement, that creates risk in the buyer’s mind.

Now is the time to start building systems that allow your business to operate independently. That includes creating standard operating procedures (SOPs), delegating responsibilities to managers, and documenting key workflows. The more your business can function smoothly without you, the more transferable and valuable it becomes.

3. Diversify Your Revenue and Customer Base

Buyers are drawn to businesses with predictable and diverse revenue streams. If most of your revenue comes from one or two clients, or from a single product or service, that’s considered risky. A drop in sales from one major source could drastically impact the company’s performance.

To reduce this risk, look for ways to expand your offerings, add recurring revenue models such as memberships or service plans, or enter new markets. Diversification creates a more stable income picture and positions your business for long-term growth.

4. Refresh Your Brand and Online Presence

Your business’s image matters especially in today’s digital world. When a buyer researches your company, they’ll likely Google your name, visit your website, and check out your reviews before they ever reach out.

That’s why your online presence should reflect the quality and professionalism of your operations. This is the time to update your website, refresh your logo or branding if needed, and make sure your business listings are accurate and consistent. Also, gather testimonials from satisfied customers and ask for positive online reviews. These may seem like small details, but they build buyer confidence in a big way.

5. Invest in a Capable Team

A strong team is a major selling point for any business. Buyers want to see that your employees are competent, loyal, and likely to stay on after the sale. If all the knowledge and customer relationships live in your head, that’s a problem.

Begin developing your staff by empowering key team members with responsibility, offering training, and setting up incentives to encourage retention. A buyer will feel far more confident making an offer if they believe the team in place can help carry the business forward.

6. Leverage Technology to Streamline Operations

Efficient systems powered by modern technology add both scalability and appeal. Whether it’s using accounting software, a CRM system to manage customers, or automation tools for inventory or scheduling, buyers want to see that your business is built on solid infrastructure.

Investing in the right tools now will not only improve your daily operations but will also signal to buyers that your business is current, adaptable, and easier to manage.

7. Prepare for Due Diligence Before It Happens

Due diligence is the final review stage of a deal, and it’s where many sales fall apart. Missing documents, unclear financials, or unresolved legal or compliance issues can make even the most enthusiastic buyer reconsider.

The good news? You can get ahead of this. Start assembling a due diligence file that includes tax records, lease agreements, employee documentation, insurance policies, vendor contracts, and anything else that a buyer may ask to see. Organizing this now shows you’re serious and helps keep your deal on track later.

Final Thoughts

Increasing the value of your business before a sale doesn’t have to be overwhelming. Small, strategic improvements made consistently over time can have a dramatic impact on your valuation, your buyer pool, and your ultimate payday.

You’ve worked hard to build your business. Now it’s time to position it to reward you. Whether you plan to sell in six months or two years, the steps you take today will shape the offers you receive tomorrow.

If you’d like a second opinion on how sale-ready your business is or where you can improve its value, reach out for confidential consultation. I’m here to help you make the most of your next chapter.

May

Thinking of Selling Your Business? Here’s Why Florida’s Top Broker Gets Results

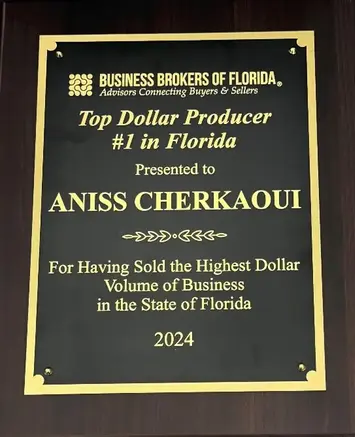

In a world where every broker claims to be the best, the truth is often hidden behind polished ads and inflated promises. But in this business, numbers don't lie and neither do the people we serve. As I reflect on 2024, I want to share more than just awards and accolades. I want to show you what it really means to be one of Florida's top-performing business brokers and why my approach is different.

The Philosophy That Drives My Work

Selling a business isn't just a transaction; it's a transition. My goal is simple: to help every seller move to the next chapter of their life with clarity, confidence, and peace of mind.

Whether or not a deal moves forward, I’m committed to offering business owners honest insights, useful tools, and full transparency throughout the process.

The Results That Speak for Themselves

In 2024, I was honored with multiple awards recognizing me as one of Florida's top brokers. But beyond the accolades, the most meaningful results came from the trust and relationships built along the way.

- Successfully facilitated transactions across a wide range of industries

- Helped business owners achieve retirement and strategic exit goals

- Guided both seasoned and first-time buyers through smooth acquisitions

- Continued to earn the trust of past clients through referrals and repeat engagements

The Stories Behind the Numbers

- Helped the owners of a major roofing company transition: one owner retired, while the other two continued their journey with the new buyer in a mid-$20 million transaction

- Assisted a school owner in successfully transitioning into retirement

- Facilitated the sale of an air conditioning company, supporting the owner's smooth transition into retirement

- Helped a young buyer acquire a medical business, allowing the seller to stay involved part-time

- Guided the sale of an electrical company, enabling the owner to continue working for a few more years before full retirement

- Managed the successful sales of a structural engineering firm, a distribution company, and a manufacturing business

Each success story represents a relationship built on trust, not just a closed transaction.

Honesty Over Hype

Not every call turns into a sale, and that's okay. I've built my reputation by telling sellers what they need to hear, not just what they want to hear.

Whether a client decides to sell now, later, or not at all, my focus remains the same: to provide honest, professional guidance that serves their best interests.

Looking Ahead to 2025

I'm not here to compete with the noise. I'm here to serve, to lead, and to continue earning trust; one conversation, one valuation, and one successful transition at a time.

If you're thinking about selling your business in 2025 or simply want a clearer understanding of what it's worth, let's have a conversation.

No pressure, no pitch. Just perspective.

Apr

What’s Your Business Really Worth? Discover the True Value Behind the Numbers

With over 20 years as a business broker, I’ve guided hundreds of entrepreneurs through the exciting yet complex journey of selling their businesses. One question always stands out: "What is my business actually worth?"

Business valuation goes beyond numbers and spreadsheets. It’s more art than science—a blend of proven methods, real-world market insight, and seasoned judgment.

If you're curious about your own business's value, you can also try our Business Valuation Calculator for a quick and confidential estimate.

Why I Trust the Market Approach to Valuation

When valuing a business, my go-to method is the Market Approach. Why? Because it’s grounded in real-world sales data from businesses similar to yours. It’s practical, accurate, and trusted by serious buyers and lenders.

Here’s why it works:

Imagine two restaurants for sale in the same city—one recently sold for three times its annual earnings, while a larger one sold for 2.5 times. By analyzing actual transactions and adjusting for factors like size, reputation, and location, the Market Approach ensures your valuation aligns with what today’s buyers are truly paying.

- Real-World Accuracy: Reflects genuine market conditions and buyer behavior.

- Objective Insights: Reduces guesswork, making your valuation credible to everyone involved.

When the Adjusted Net Asset Method Makes Sense

While the Market Approach is my preferred method, the Adjusted Net Asset Method provides important insights—especially for businesses that own significant assets or are not yet profitable:

- Clear Baseline: Establishes a minimum value based on tangible assets and liabilities.

- Transparency: Makes it easier for buyers and lenders to clearly understand the business’s worth.

Why Discounted Cash Flow (DCF) Isn’t Always Reliable

You might have heard of the Discounted Cash Flow (DCF) method. While popular, it’s highly subjective—relying heavily on assumptions about future earnings, growth rates, and market conditions.

Even slight changes in projections can significantly affect the final number. That’s why I favor valuation methods that stay firmly rooted in real market activity.

Business Valuation Is an Art—Guided by Science

Every business has a unique story.

For example, a neighborhood coffee shop with decades of loyal customers carries a different market appeal than a fast-growing tech startup. These intangibles can't be captured by numbers alone.

Accurate business valuation requires intuition, market knowledge, and an understanding of what buyers truly value. Numbers tell part of the story—the rest is experience, judgment, and insight into subtle market dynamics.

Ready to Discover What Your Business Is Worth?

Combining proven valuation methods with decades of hands-on experience, I can help you uncover your business’s true value—not just on paper, but in today’s real-world market.

Get a quick estimate now using our confidential Business Valuation Calculator, or reach out for a personalized consultation.

Let’s navigate this important journey together.

Apr

Unlocking the True Value of Your Business in Miami, Broward & Palm Beach

How Our Business Valuation Calculator Empowers South Florida Business Owners

Are you planning to sell your business in Miami, Broward, or Palm Beach County? Are you seeking investment, or simply curious about your company’s market value? A reliable business valuation forms the foundation for making informed, strategic decisions. At Transworld Business Advisors, we understand that most business owners lack the time or expertise to conduct a comprehensive financial analysis.

That’s why Aniss Cherkaoui—an experienced Florida business broker with over 20 years of expertise—developed the Free Business Valuation Calculator. This fast, insightful, and confidential tool is designed specifically for Main Street businesses in South Florida.

Why Business Valuation Matters in South Florida

Understanding your business’s value is not limited to exit planning. A proper valuation can:

- Help determine the best time to sell in Miami, Broward, or Palm Beach

- Reveal your company’s strengths and weaknesses

- Assist with succession or estate planning

- Support negotiations with buyers, lenders, or potential investors

- Provide peace of mind as you plan for the future

Many business owners either overvalue or undervalue their companies—especially in competitive markets like South Florida—leading to missed opportunities or undervalued sales.

What Makes Our Calculator Stand Out?

Unlike generic valuation tools, our calculator draws on real-world insights from thousands of hours spent working with business owners throughout Miami, Fort Lauderdale, and West Palm Beach. It evaluates key factors that drive the value of local small businesses, including:

- Revenue and profitability

- Industry-specific risks

- Owner involvement

- Growth potential

- Buyer demand in your local market

With just a few simple inputs, you’ll receive a realistic valuation range, quickly and confidentially.

A Starting Point—Not the Final Answer

This calculator provides an estimate—not a formal valuation. While it offers a reliable starting point, many unique elements contribute to a business’s true market value, including:

- Customer relationships and loyalty

- Local brand reputation

- Proprietary systems, licenses, or intellectual property

- Organizational structure

- South Florida market trends

Valuing a business is both an art and a science. If you are serious about selling, working with an experienced business broker ensures you obtain the most accurate and strategic valuation possible.

Why Business Owners in Miami, Broward & Palm Beach Still Need a Broker

Although our valuation tool is simple, fast, and user-friendly, it is only the first step. A comprehensive valuation requires a deeper analysis of your company’s internal strengths and external market conditions. This thorough review helps identify the key drivers of your business value—and how to enhance them before going to market.

For a personalized valuation and expert guidance tailored to your business and local market, contact Aniss Cherkaoui today. With over two decades of experience assisting South Florida entrepreneurs in buying and selling businesses, Aniss will guide you through every stage of the process—from pricing and negotiation to closing.

Who Should Use This Calculator?

Our Free Business Valuation Calculator is ideal for:

- Business owners in Miami, Broward, or Palm Beach considering a sale

- Entrepreneurs interested in understanding their current market value

- Individuals preparing for retirement or succession planning

- Buyers evaluating a business’s asking price

The tool is 100% confidential, mobile-friendly, and easy to use.

Try the Free Business Valuation Calculator Now

If you’re a business owner in South Florida, get an instant estimate of your company’s value using our free tool. Then, let’s discuss how to turn that insight into a successful exit strategy.

Apr

When It’s Time to Sell: A Business Owner’s Guide to a Strategic Exit

Selling your business isn’t just a transaction—it’s a transformation. For most entrepreneurs, it represents the culmination of years, if not decades, of hard work, growth, and dedication. And yet, despite the significance of this decision, many business owners approach it without a clear strategy.

In my experience advising sellers across a wide range of industries, the most successful exits don’t happen by chance. They are the result of a structured, well-timed process that aligns financial outcomes with personal goals.

Step 1: Clarify the Destination Before You Pack the Bags

Before we talk about valuations or buyers, let’s ask the most important question: What are you trying to achieve?

Some owners want to fully exit and retire. Others aim to stay partially involved with a new partner to continue growing the company. Some simply wish to de-risk and take a portion of their equity off the table. Understanding your "why" is the foundation for designing your "how."

Step 2: Prepare the Business Like You’re Buying It Yourself

Would you enthusiastically buy your own company at full market value today? If the answer is anything but a confident yes, there’s work to be done.

This stage includes:

- Normalizing financials and removing discretionary spending

- Identifying operational strengths and potential risks

- Crafting a compelling business narrative that highlights value drivers

This is what I call “exit readiness”—and it’s often where the most value is created or lost.

Step 3: Execute an Intentional Buyer Outreach Strategy

We don’t wait for the right buyer to show up—we go find them. Our approach is both proactive and strategic, connecting your business with serious, qualified acquirers, such as:

- Strategic buyers seeking synergies

- Private equity groups with capital to deploy

- High-net-worth individuals looking for strong, operational investments

Our objective is to generate multiple offers, create competitive tension, and give you the freedom to select the best fit—not just the first offer.

Step 4: Navigate the Negotiation Maze with Precision

A signed LOI (Letter of Intent) is only the beginning. From that point on, we manage:

- Due diligence (financial, legal, operational)

- Deal structuring and tax strategy

- Coordination with attorneys, CPAs, and other advisors

Having a skilled advisor protects your deal from value erosion and ensures that each step moves forward with clarity and confidence.

Step 5: Closing Is Just the Beginning

Selling your company marks the end of one journey—and the beginning of another. Whether you're heading into retirement, launching a new venture, or simply taking a breath, our role is to make sure you do it with clarity, confidence, and peace of mind.

Final Thoughts from the Deal Table

If you’re thinking about selling within the next one to three years, the time to start planning is now. Strategic exits don’t just happen—they’re built.

Aniss Cherkaoui specializes in helping business owners navigate this process with integrity, precision, and a strong focus on outcomes. Your business represents your life’s work. Let’s make sure your exit reflects that.

Ready to Explore Your Options?

If you're considering a sale—or simply want to understand your company's value in today's market—I invite you to schedule a confidential consultation.

(561) 340-3681

aniss@tworld.com

Schedule a Call

Mar

How to Maximize Your Business’s Value Before You Sell

How to Maximize Your Business’s Value Before You Sell

Selling a business in South Florida isn’t just about finding a buyer—it’s about attracting the right buyer at the right price. Whether you're preparing for retirement, exploring new ventures, or simply ready for a change, maximizing your business’s value before going to market is essential.

The good news? With the right preparation, you can boost buyer interest, increase your valuation, and accelerate the closing process.

Why Preparation Is Key

Today’s buyers are discerning. They compare multiple opportunities, assess risk, analyze financials, and evaluate growth potential. The more prepared and appealing your business is, the better your chances of attracting serious, qualified buyers.

By preparing in advance, you can:

- Position your business as a smart, low-risk investment

- Minimize roadblocks during due diligence

- Generate stronger interest and multiple offers

- Gain greater leverage during negotiations

Your goal: Make your business one buyers can’t ignore—and one they’re willing to pay a premium for.

1. Elevate Your Brand

Your brand is your story. It communicates your value, builds trust with customers, and signals longevity to potential buyers. A strong, consistent brand adds both emotional equity and financial value.

Ways to strengthen your brand:

- Refresh your visual identity (logo, website, marketing materials)

- Align your online presence with your brand values and target audience

- Highlight genuine customer testimonials

Pro tip: Buyers will research your website and social media early on. Make that digital first impression count.

2. Streamline Your Operations

Efficient operations are attractive because they reduce a buyer’s need to "fix" things post-acquisition. A well-organized business shows it can run smoothly without constant oversight.

What to optimize:

- Document repeatable processes for daily operations

- Implement tech tools to reduce manual work

- Eliminate unnecessary overhead expenses

Buyer mindset: “Can I run this business smoothly without being an expert in the industry?”

3. Organize and Clean Up Financials

Financial transparency builds trust. Clean, accurate records are one of the most powerful confidence boosters for potential buyers.

Steps to take:

- Ensure financial statements are current and accurate

- Separate personal and business expenses

- Highlight revenue trends, profitability, and recurring income

Pro tip: A pre-sale financial review or light audit can reveal hidden value—and resolve issues before they become deal-breakers.

4. Diversify and Stabilize Revenue

Buyers are wary when too much revenue depends on a single client, product, or season. Balanced, stable revenue streams make your business appear safer and more scalable.

How to diversify:

- Introduce new products or services aligned with your core offerings

- Expand into new markets or demographics

- Build recurring revenue through subscriptions, memberships, or retainers

Bottom line: Predictable, diversified income = higher perceived value.

5. Build a Business That Runs Without You

A business that operates independently is far more valuable. Buyers want to know success doesn’t hinge on the current owner.

How to prepare:

- Delegate key responsibilities to managers or team leads

- Develop and document standard operating procedures

- Create a retention plan for top-performing employees

Pro tip: A self-sufficient team increases buyer confidence—and boosts deal value.

6. Upgrade Your Technology Stack

Outdated systems can be red flags. Modern, scalable technology enhances efficiency and signals that your business is future-ready.

Consider upgrading:

- CRM and marketing automation tools

- Cloud-based accounting, inventory, and HR software

- E-commerce or online service platforms

Tech-savvy = scalable = valuable.

7. Strengthen Customer Loyalty

Loyal customers are proof that your business delivers. High retention and repeat business are strong selling points.

How to build loyalty:

- Launch a rewards or loyalty program

- Personalize communication and service

- Track and improve customer satisfaction metrics

Bonus: Customer retention data provides evidence of consistent, reliable revenue.

Final Thought: Sell From a Position of Strength

Maximizing your business’s value doesn’t happen overnight—but the earlier you begin, the more rewarding your exit will be. By enhancing your brand, streamlining operations, empowering your team, and tightening financials, you’ll stand out as a premium opportunity in any market.

Thinking About Selling or Curious What Your Business Is Worth?

I offer complimentary, confidential business valuations—no pressure, no obligation. Whether you’re just exploring options or ready to begin the process, I’m here to help you make informed, strategic decisions.

Dec

Start 2025 with Clarity: What Is Your Business Worth Today?

As we say goodbye to another year and welcome 2025, this time offers a valuable opportunity for reflection and planning. For business owners, it is a chance to carefully assess the direction of their business and think about their long-term goals.An important question to ask during this time is: What is my business worth today if I plan to sell in the near future?

Knowing the current value of your business is not just about preparing for a possible sale. It is about gaining meaningful insights to make informed decisions and align your goals strategically, especially if an exit may happen soon. By understanding your business’s worth today, you set the stage for a successful and timely sale.

Why Understanding Your Business’s Value Is Important

The value of your business provides a clear picture of where it stands in the current market. This information can be extremely useful for several reasons:

- Create an Exit Plan: Knowing your current valuation helps you design a thoughtful plan that matches your financial and personal goals, especially if selling is on the horizon.

- Prepare Your Business for Buyers: A valuation often reveals areas where your business can improve to attract more buyers. Taking steps now can increase the chances of achieving the price you want.

- Seize Opportunities: In the fast-changing world of business sales, being prepared is key. Having an updated valuation means you can act quickly if the right buyer or market conditions appear.

Steps to Reach Your Desired Valuation

Many business owners have a specific sale price in mind. Achieving that price usually requires careful planning and action. Starting the valuation process now can help you:

- Find the gaps between your current valuation and your target sale price.

- Make changes that increase your business’s appeal, such as improving operations, boosting profitability, or building customer loyalty.

- Position your business to reach the valuation needed for a successful sale within your desired timeline.

A Special Offer for Florida Entrepreneurs

If you are thinking about selling your business in the near future—within the next 12 to 24 months—I am offering a free, no-obligation business valuation designed specifically for you. This process gives you an accurate understanding of your business’s current value, along with practical advice to strengthen its position and improve your outcomes.

This is not about predicting future possibilities. It is about providing clear insights into your business’s current worth and developing a plan to maximize its potential within your chosen timeline.

Take the First Step Today

The best time to start preparing for your business’s sale is now. Waiting for opportunities to appear may lead to missed chances—being prepared ensures you can act with confidence when the time comes. Contact me today to schedule your free valuation and begin the process of positioning your business for its next chapter.

Here’s to a successful 2025 and achieving your business and financial goals!

Oct

Why Business Brokers (Not Magicians) Can’t Sell Overpriced Listings—And How a Reality Check Can Save the Day!

Ever wish you could wave a magic wand and—poof—sell a business for far more than it’s worth? I get it. But unless you’re a magician, overpricing a business isn’t going to conjure buyers out of thin air. Spoiler alert: we’re business brokers, not wizards.

In our world, the real magic lies in understanding numbers, market trends, and what buyers are genuinely willing to pay. If you overprice a business, it’s like handing someone a treasure map with no treasure at the end—no one’s buying it! That’s where the Most Probable Selling Price (MPSP) comes in, guiding you toward a fair deal grounded in reality.

Why Overpricing a Business Won’t Cast a Spell on Buyers

-

Buyers Aren’t Fooled by Illusions: Buyers aren’t under any enchantment—they’re sharp, savvy, and always on the lookout for real value. If you think slapping an inflated price tag on a business will lure them in, think again. They’ve got calculators, spreadsheets, and a healthy dose of skepticism. No amount of magic dust will change what they’re willing to pay.

-

The Vanishing Buyers Act: Instead of attracting buyers, overpricing a business usually makes them disappear—like trying to find Atlantis. Your listing gathers dust while buyers sail past in search of better deals. You can wave that wand all you want, but it won’t make buyers reappear.

-

Old Numbers Don’t Lie: Unlike pulling a rabbit out of a hat, you can’t just pull numbers from nowhere. The magic we work with comes from market comparables, tax returns, profit & loss statements, balance sheets, and the cold, hard truth. These are the real stars of the show, and if your price doesn’t match up, buyers will see right through the illusion.

The Reality Check (No Magic Required)

But don’t worry—before you conjure up a price out of thin air, we’ve got a tool to bring you back to reality: our business valuation process. Think of it as your guide to discovering the Most Probable Selling Price (MPSP) of your business. This reality check helps sellers avoid overpricing and keeps them on track toward a successful deal.

No tricks, no illusions—just the actual value of your business, clearly laid out. Because if your price doesn’t align with the market, buyers won’t bite, no matter how flashy your presentation is.

The Real Trick: Price It Right

We may not be magicians, but we have something better—real market expertise and a customized business valuation that leads straight to the MPSP. When you price a business right, buyers follow, because in this game, the real magic happens when the numbers add up and everyone wins.

So, the next time you’re tempted to pull off the ol’ “overpriced listing” trick, remember: we’re business brokers, not wizards. The only magic we believe in is the kind that turns a well-priced business into a smooth, successful sale.

Oct

The Decision is Yours: 1. Grow, 2. Sell, 3. Do Nothing — Why Selling Now is Your Best Move

As a business owner, you are constantly faced with important decisions about the future of your business. However, none is more critical than deciding whether to grow, sell, or do nothing. While each option has its merits, today’s market conditions make selling your business a particularly compelling choice. In fact, for many business owners, the decision to sell now could be the smartest move.

So, what will you choose? Let’s explore why selling now might just be the best decision you can make.

1. Grow: Is It the Right Time?

Growth is always an option. However, it requires reinvestment—of your time, energy, and capital. Expanding your business in today’s environment presents significant challenges with rising competition, increased operational complexity, and ever-changing market dynamics.

Before deciding to grow, consider:

- Do you have the appetite for more risk? Growth often means taking on debt or additional responsibilities, which can strain your current operations.

- Are you prepared for the long-term commitment? Expansion requires a long-term strategy, and it could take years before you see the benefits of scaling up.

While growth is exciting, it also brings more stress, more risk, and more uncertainty.

2. Sell: Capture Maximum Value Now

In today’s market, selling your business is not just an option—it’s an opportunity. With a strong economy, active buyers, and favorable conditions, you can sell your business for maximum value.

Here’s why selling now makes sense:

- The market is hot. There is currently an influx of buyers—private equity firms, strategic buyers, and high-net-worth individuals—eager to invest in businesses like yours. This means higher demand and better valuations for sellers.

- Interest rates are stabilizing. While interest rates have risen in recent times, they are stabilizing, allowing buyers to adjust and make more confident purchasing decisions.

- Your business is likely at its peak. If your business has been growing steadily, now is the time to capitalize on that success. Waiting for "just one more year" could result in missed opportunities if market conditions change.

Selling now allows you to unlock the full value of your business and move on to your next venture—whether that’s a new challenge, early retirement, or simply enjoying the fruits of your labor.

3. Do Nothing: The Hidden Risks

It might seem comfortable to stay the course, but doing nothing comes with its own risks.

- Markets change. The business world is evolving faster than ever. Delaying your decision could result in a less favorable market in the future. If the economy dips or buyer interest cools, the value of your business may decrease.

- Owner fatigue. Running a business is demanding, and burnout is real. If you’re feeling exhausted by the day-to-day grind, it may be time to consider an exit before it takes a toll on your business’s performance.

- Competition is growing. In many industries, competition is becoming fiercer, and technology is advancing rapidly. If you’re not growing, competitors may start to outpace you, which could reduce your business’s value over time.

Choosing to "do nothing" might feel safe, but it could be the riskiest decision of all.

The Time is Now—Here’s Why You Should Sell Today

In a market that favors sellers, the opportunity to sell your business for top dollar is right now. Waiting could mean missing out on these prime conditions. And with the right broker by your side, you don’t have to navigate this process alone.

Why choose me as your broker?

- Market expertise. I specialize in helping mid-market business owners like you maximize their return when selling. I have access to a wide network of qualified buyers who are ready to act now.

- Accurate business valuations. I provide a thorough, market-based valuation of your business, ensuring that you understand its true worth in today's market.

- End-to-end support. From preparing your business for sale to negotiating the best deal, I handle every step of the process to ensure a smooth transaction.

The decision is yours: Grow, Sell, or Do Nothing—but remember, the opportunity to sell at peak value may not last forever. Let me help you navigate the process and secure the future you deserve.

Contact me today to discuss your options and take the first step toward a successful exit.

Sep

Finance Options for Buying a Business in Florida

When it comes to buying a business, one of the most crucial factors prospective buyers must consider is how to finance the acquisition. There are several ways to finance the purchase of a business, each with its own advantages and considerations. Below, we explore the most common financing options available to business buyers in Florida.

1. Buyer Financing

In some cases, buyers have enough cash on hand to cover the purchase of a business. Alternatively, they may leverage their personal assets, such as equity in a home or other real estate, to raise the necessary funds. Other assets, like investments or vehicles, can also be sold or borrowed against to finance the acquisition.

2. Bank Financing

Banks are a primary source of financing for business purchases. They often lend against the buyer’s personal assets and, in many cases, against the assets of the business being acquired. However, the bank will carefully assess the business’s value, profitability, and future potential to ensure the loan is justified. Ultimately, the business must demonstrate sufficient value to support the loan amount.

3. Venture Capital Firms

Venture capital firms generally focus on large businesses with significant growth potential. These firms usually provide funding in exchange for an equity position in the company. While venture capital can provide substantial resources, it is not a common financing option for small to mid-sized businesses.

4. SBA Loans

The U.S. Small Business Administration (SBA) offers one of the most popular financing options for small and medium-sized business purchases. An SBA loan, though technically obtained from a bank, is backed by the SBA, reducing the bank's risk. The 7(a) SBA loan program is designed to help buyers secure financing for a range of business-related needs, including acquisitions.

With an SBA-backed loan, buyers typically enjoy more favorable terms than traditional bank loans. Many banks offer up to 10 years for repayment with no balloon payments or prepayment penalties. If the acquisition involves commercial real estate, the loan terms may be extended. Some banks, known as preferred SBA lenders, have greater authority to approve loans, making the process faster and more advantageous for the buyer.

5. Seller Financing

In many small business transactions, seller financing plays a critical role. This option involves the seller providing financing for part, or sometimes even the majority, of the purchase price. While most sellers prefer to receive all cash at closing, offering seller financing can increase a buyer's confidence in the transaction. When a seller agrees to provide financing, it shows they believe in the business’s ability to service the debt and support the buyer’s livelihood.

Conclusion

When buying a business in Florida, exploring your financing options is essential to finding the right path forward. From leveraging personal assets to securing bank loans, SBA financing, or seller-backed financing, each option offers different benefits depending on your financial situation and the nature of the business.

For personalized guidance on how to finance a business acquisition, feel free to contact me:

Aniss Cherkaoui, Senior Business Advisor & Intermediary

Transworld Business Advisors

m: (305) 608-6761

t: (954) 340-3681

e: aniss@tworld.com

Sep

The Evolving Personal Care Industry: Is 2024 a Good Time to Sell Your Beauty Business in Broward County?

The personal care industry experienced significant changes during the pandemic, with many businesses adapting by shifting online, embracing natural and sustainable approaches, and innovating their services. Now, in 2024, the world has fully reopened, and beauty businesses have rebounded stronger than ever. You may be wondering—is now a good time to sell your beauty or personal care business in Broward County?

The short answer is yes. Selling a beauty or personal care business in today’s market requires strategic timing, especially in high-demand regions like Broward County. Let's explore the factors that can impact the sale and maximize the value of your business.

Key Factors in Selling a Personal Care Business

Selling a beauty or personal care business isn’t very different from selling other types of businesses. However, it’s essential to consider how well your business is performing in today’s competitive market.

Here are a few factors that can significantly affect your sale:

-

Location: Broward County offers a growing population and a booming tourist sector. If your beauty business is situated in a high-traffic area like Fort Lauderdale or Hollywood, you’re already ahead. Buyers are increasingly interested in locations with strong foot traffic and easy accessibility.

-

Condition of Your Space: The physical condition of your beauty business matters. Buyers will want to know if the space is up to date, clean, and well-maintained. With post-pandemic standards, cleanliness and health compliance are more important than ever. Make sure your permits, equipment, and general aesthetic are in excellent shape to appeal to prospective buyers.

-

Ownership Structure: Whether you lease or own your space can impact your sale strategy. In Broward County, where commercial property values are rising, owning your property can provide a significant advantage. You’ll have the flexibility to either sell the property or lease it to the new business owner.

Types of Beauty Businesses That Are Thriving in 2024

The personal care industry is diverse and resilient. Whether you operate a hair salon or a luxury day spa, there’s a strong demand for beauty services across Broward County. Here’s a look at some of the top-performing segments in 2024:

- Hair Salons

- Skin Care and Massage Services

- Nail Salons

- Day Spas

- Barbershops

- Brows and Lashes Studios

- Waxing and Hair Removal Centers

- Beauty Supply Stores

- Tanning Salons

- Body and Ear Piercing

- Makeup and Beauty Bars

Why the Personal Care Industry is Still Booming

While many industries struggled, beauty businesses have shown remarkable resilience post-pandemic. This can be attributed to the resurgence of social events, weddings, and travel in Broward County and beyond. According to a report from The Knot, the number of weddings has surged back to pre-pandemic levels, with 2023 seeing a significant uptick in wedding-related beauty services.

Additionally, the focus on self-care, wellness, and sustainability has only grown. Consumers want more personalized, natural, and holistic beauty experiences, which opens new growth opportunities for businesses in the space. According to McKinsey & Company, the personal care market has experienced steady growth, driven by rising consumer interest in wellness and self-care.

According to a report by Statista, the beauty and personal care industry is expected to grow at a compound annual growth rate (CAGR) of 4.75% through 2024, indicating ongoing demand and opportunities for sellers.

Selling Your Beauty Business in 2024: What You Need to Know

If you’re considering selling your beauty business, here are the key steps to ensure a smooth and profitable transition:

-

Business Valuation: Knowing your business’s value is the first step. At Transworld Business Advisors, we offer a FREE business valuation tool to help you assess your hard work and determine the best price. Accurate valuation is crucial in the thriving Broward County market, especially with rising property values and high demand for beauty services.

-

Financial and Asset Review: Ensure your financial records, equipment, inventory, and assets are organized and up to date. Buyers will be particularly interested in profitability, client lists, branding, and your business's reputation.

-

Choose the Right Business Broker: Working with an experienced business broker like Aniss Cherkaoui can make all the difference in selling your beauty business. With extensive experience in Broward County, Aniss can help you navigate the process and achieve a successful sale.

Ready to Sell Your Beauty Business?

Selling a beauty business in Broward County in 2024 presents an exciting opportunity. With the right preparation, your business can attract qualified buyers and secure a lucrative sale. Whether you're looking to retire, switch industries, or pursue a new venture, the time is right to make a move.

Contact Aniss Cherkaoui today to schedule a FREE consultation and learn more about how Transworld Business Advisors can help you successfully sell your personal care business.

Jul

How to find the best advisor when selling your business

The era of do-it-yourself home repairs may have had its moment. Still, those who've closely followed this trend quickly realized the advantage of having a professional remodel their homes for superior quality work. This truth extends to significant endeavors like selling your business. While you may know your business inside and out, understanding the nuances of marketing, vetting potential buyers, and securing the best deal is a different skill set.

So, if you've decided to sell your company, how can you find the right broker or advisor to assist you while allowing you to focus on running your successful business? When interviewing potential brokers for this critical role, here are three essential considerations:

- The Type of Advisor You Need: Kickstart your search for a business broker by concentrating on advisors who can delve into your business's intricacies and prepare it for sale. This requires a deep knowledge of the business selling process and an extensive professional network interested and capable of purchasing your company. Transworld advisors excel in these aspects, as outlined below.

- The Size of the Business Advisor: Opinions abound regarding the size of a business advisor - smaller ones offer personalized service, while larger firms boast a broader marketing reach. Transworld uniquely combines the best of both worlds as a franchised business, offering a personalized, local broker experience supported by the resources of a more prominent corporate-like firm. Benefits include access to a database of over 300,000 potential buyers and assistance organizing your company's financials before the sale.

- Credibility and Success of the Advisor: It's crucial to evaluate your potential advisor's credibility and track record. Confidentiality is paramount when selling your business, as leaks can concern suppliers, employees, and customers, affecting profitability. Additionally, you want an advisor known for securing top-dollar deals. Transworld's extensive experience selling over 15,000 businesses showcases our ability to maintain confidentiality and maximize sale prices.

During interviews with potential advisors, consider asking these key questions:

- What industries does the advisor serve? Transworld boasts brokers with resources to market businesses across various sectors successfully.

- What is their step-by-step process, and how long does it typically take?

- What are their fee structures?

- How many of their transactions have been successful or unsuccessful?

Deciding to sell your business is both thrilling and stressful. At Transworld, our advisors are among the industry's most sophisticated and experienced professionals. With the expertise and reputation you seek, our Business Advisors can guide you toward securing the best deal. Schedule a free consultation today to begin this journey.

Aug

Fees and Expenses to Expect When Selling a Business

When you sell your business, you expect to make money—not spend it. But as the saying goes, you have to spend money to make money. The question is, how much?

The answer isn’t always clear. However, most brokers agree that a certain amount of due diligence is necessary when preparing a business for sale. That means retaining qualified professionals to look over your books, guide you through legal processes, and anticipate various fees associated with selling.

As a seller, you’ll soon discover some costs are avoidable, some are essential, and others are optional. The list below covers some of the more common ones. For more detailed information, we encourage you to speak to a broker about your situation—we’re more than happy to advise.

1. Brokerage Fees

Speaking of essential costs, brokerage fees are the expenses that deliver the most bang for their buck.

Often our fee is negligible compared to the money we’re able to garner for the seller.

Every business owner should know that brokers are investments worth making. Brokers protect sellers’ best interests, answer their questions, anticipate complications, and smooth the selling process. They can—and have—saved business owners hundreds of thousands of dollars.

Good to know: broker fees vary greatly. Some ask for a percentage of the sale, which could vary based on the business’s value. In choosing a broker, just be sure to consider their experience, their reputation, and their resources. The one that’s right for you will have all these things in abundance and be ready to put them to work for you.

2. Professional Fees

This family of costs is closely related to legal obligations, liabilities, and risks.

Major influences include transaction complexity and structure: how easy or difficult will it be to sell your business? It depends on the current state of your operation, plus whatever it takes to bring it up to par.

For example, CPA fees related to bookkeeping fall under this umbrella, as well as that of due diligence.

Your broker should be able to recommend professionals they know and trust—industry experts they’ve come to rely on over the course of several years.

As Cagnetta says, “You can pay the wrong professional to learn about due diligence…or you can pay the right one to avoid the complexities.”

3. Hidden Costs

Brokerage fees you likely anticipated. Professional fees you might have anticipated. Hidden costs are—well, hidden. These are the expenses many business owners don’t consider when preparing to sell.

There are as many hidden fees in business transactions as there are businesses. We jest—but there are a lot, and they’re another reason we strongly recommend recruiting a broker. Just a few include…

- Taxes, tax leins

- Machinery/equipment appraisals

- Employee severance & vacation time

- Lease assigning issues & landlord negotiations

- Additional CPA fees to prepare books & records

- Prepayment penalties on leases or loans

Spotting hidden fees can be challenging because they come in so many shapes and sizes. Be on constant alert for openings that allow buyers, accountants, and lawyers to attempt re-trades or re-negotiations.

After all this, you may be wondering: are these expenses avoidable?

Perhaps. But to determine that, you’ll need a good broker—someone with the experience and resources needed to recognize avoidable costs. Brokers act as referees between the seller and other parties, protecting them and guiding them through complex proceedings.

Bottom line: brokers cost money, but they also save sellers much more money. In addition to that, they save time, energy, and peace of mind which can be priceless.

Aniss Cherkaoui knows that running your business is the most important thing you can do as an owner, especially during negotiations. Contact me to learn how I deliver the most value to sellers in every transaction.

Aug

Business Trends to Look Out for in 2022

2021 was a year of unpredictable firsts for business owners and entrepreneurs. Nothing we learned in 2020 could have prepared America for pandemic shutdowns. Many small operations had to quickly pivot, improvise, and adapt to a world that changed overnight.

But now, with a swiftly recovering economy and growing consumer demand, we have the room (and the data) to make educated predictions about 2022. Nothing is ever certain—but after a successful year of serving clients, making sales, and gathering information, Transworld is pleased to share our 2022 forecast for trends in business transactions and acquisitions.

Read on to find out what we learned and start planning your next steps with confidence.

Looking at 2021 to Predict 2022

To kick things off, let’s briefly revisit the business sales trends that characterized 2021. (Don’t worry, we won’t stay long.)

- Sector-specific growth. Restaurants, retailers, tourism, events, and healthcare providers saw considerable surges after reopening. Consumers were eager to get back out into the world.

- More businesses sold. In 2021, business owners that sold their operations found sellers more quickly than ever before. Their businesses also sold for higher prices than in recent history.

- Ecommerce got hotter. Of course, e-commerce has been popular…but during the pandemic, when brick-and-mortar stores were closed, online shopping grew even more popular.

These were more than just trends—they were history in the making.

At Transworld, we witnessed it firsthand. We knew we were experiencing something unprecedented—and we paid close attention so we could pass the benefits off to entrepreneurs like you. Aniss Cherkaoui worked with countless clients who took advantage of surging business sales and collected tidy profits.

These experiences helped us extrapolate and make predictions for 2022:

- Demand will continue to increase for small businesses. In 2021, the average price of businesses grew by almost 40%. Sellers will be able to net more than usual if they plan their exits now.

- Inflation and supply chain obstacles will lessen over time. Inflation may affect profits in the short run, but supply chain issues and rising costs should dissipate However, if the cost of goods keeps increasing and businesses keep being squeezed, more will come up for sale.

- Ecommerce and automation will become much more common. With labor costs rising, many business owners are updating their operations to depend less on human employees.

In short, business was good in 2021—and business will continue to be good in 2022. If selling has ever crossed your mind, now is the time to think more seriously about your plans. Aniss Cherkaoui has helped many successful entrepreneurs sell their operations. Will this be the year you join their ranks?

What You Can (and Should) Do Now

No one can tell you when to sell your business. What we can do is help you look at the facts and make an informed decision based on what we’ve learned. This is Aniss’s specialty: it’s the reason he’s trusted by entrepreneurs. Contact us to discuss your next steps in detail.

Aniss Cherkaoui can help you stay advised with expert knowledge on the latest market trends. He watches other sellers and buyers in your industry to help you stay up to date on changes as they occur.

In the meantime, always keep running your business. Never pause operations while you search for buyers, entertain offers, or explore other ventures. Buyers want to get what your business will earn in the future, and if your business’s profitability drops before it’s sold, you may have some explaining to do and could see a negative price adjustment.

Footer© 2022 GitHub, Inc.Footer navigationTermsPrivacySecuritySt

Jul

How Quickly Can I (or Should I) Sell My Business?

In a perfect world, every entrepreneur would have ample time to prepare their business for sale. It’s a long, often complex process that demands our full attention—and ideally, assistance from professional brokers. After all, there are many, many factors to consider: Why am I selling? Is the market ideal? Do I have my legal and financial ducks in a row? (And more.)

That being said, there are certainly times when a speedy sale is essential—or unavoidable. Life can change in a moment, and when an urgent situation demands your attention, it helps to know that Transworld’s advisors are here to help facilitate your business’s sale with haste and precision. This is especially applicable to the fast-moving market that emerged during the COVID-19 pandemic.

Why Sell Quickly?

If you find yourself in a situation that calls for a quick sale, you’re not alone. Our advisors have helped many clients accelerate the process—and for many, many different reasons.

- A sudden change in personal circumstances. An unexpected illness or even a death in the family, divorce, and partnership disputes have compelled many of our clients to sell quickly.

- Favorable (or unfavorable) market changes. Whether they affect your vertical as a whole or your business’s individual profitability, market changes frequently kick-start the sales process.

- New (and potentially profitable) opportunities. Perhaps you’ve found an exciting new venture and need to hand off responsibility—or, you need to find more capital quickly.

Selling quickly is also just plain trendy. BizBuySell.com reports: “[the] median time to sell dropped 23 percent from its peak of 200 days in Q2 2012 to just 153 days in Q4 2014.” That’s the lowest sale time recorded since they began tracking in 2007.

Time-Consuming Roadblocks

With any business sale, there are certain steps that need to be taken to protect you and your business. With an expedited business sale, these steps are still essential—but now, with everyone moving twice as quickly, there’s more room for error. That’s where business brokers come in.

- We find and vet potential buyers. Once your business goes up for sale, you’ll likely receive a flurry of requests for more details. Aniss Cherkaoui will field these requests and share only the essentials, all the while keeping your business’s important information confidential.

- We prepare your business for sale. While you do the important work of keeping your business running and profitable, we gather the information needed to value and list it—plus important documents regarding your financial obligations, legal obligations, and due diligence.

- We screen negotiations and paperwork. Don’t be taken in by a seemingly perfect buyer. If it seems too good to be true, it probably is. Our advisors have decades of experience and know what’s normal in a deal, when to accept an offer, and when to die on a particular hill.

Ways to Expedite Your Sale

Having a trustworthy business broker at your side to facilitate a quick sale is the best thing you can do when time is of the essence. However, there are also many steps that entrepreneurs can take themselves to make their businesses attractive and speed up the process.

- Target the most likely buyers. This seems obvious, but many of our clients forget to look in their own backyards. The best buyers for your business could be the people in your industry, old business connections, and maybe even former rivals and competitors.

- When looking for buyers, cast a wide net. You never know where your buyer will come from. You may be surprised to find buyers in unlikely places, but don’t shut the door on them. Keep an open mind and trust Transworld’s international reach—our database has thousands of contacts.

- Sweeten the deal by adding incentives for potential buyers. We don’t just mean lower prices (though everyone loves a deal). Try throwing in financing options, equipment, and other bonuses to attract interest and show you’re serious about selling your business quickly.

Conclusion

If you need to sell quickly, you absolutely must have an experienced broker to facilitate the process. Errors can slow you down and waste your time. Remember, a good deal dies when you don’t have the professional guidance needed to navigate next steps. Don’t get caught without Aniss Cherkaoui, who knows his way around preparation, negotiation, and closing.

Aniss Cherkaoui takes the stress out of selling your business so you can focus on your exit—whatever that may look like for you. It’s impossible to put a price on the peace of mind that comes from knowing you’re covered—financially and legally—as you see off your business to the next phase of its life.

Contact us to find out more about fast sales and how we protect our clients during every phase.

Jul

How Inflation Impacts the Sale of your Small Business

From the pandemic’s supply chain issues to the current worries over rising inflation, many small businesses have struggled to adapt to the sudden shifts in today’s economy. With inflation in June hitting 9.1%, more than the Dow Jones estimate of 8.8% for the month, more and more businesses are worrying about how exactly inflation has and will impact their business and if now is the time to sell.

Let’s examine the major factors involved:

Rising prices

While the Fed has raised interest rates to help offset the recent surge in inflation, those increases take some time to work. In the meantime, inflation has increased the cost of raw materials, creating a domino effect of increased prices. What does this mean for a small business?

To start, it means that what the business pays for supplies and services to keep their company afloat has increased. They can raise their prices to offset how much more they are spending on materials. The drawback of this option is that some customers simply may not be able to absorb the extra expense, and you lose their business.

Overhead expenses

Next, many small businesses have been looking for ways to cut costs to offset the rising inflation. This can be done by reducing inventory, making budget cuts, or simply getting creative with new ways to bring in money.

But ongoing labor shortages and supply chain issues may make this option more challenging than normal. Additionally, as consumers and other businesses look to tighten their purse strings, many small businesses may find themselves facing delayed or canceled orders, which further cut into their profits.

Narrower profit margins

The final option for a small business is to simply accept a slimmer profit margin, meaning less money to save or funnel back into the business. Inflation doesn’t just affect businesses, it affects consumers as well, who must search for ways to make their paychecks go further.

You may find your business’s growth begin to slow or flatten. Over time, it may even become harder to turn a profit. If selling your small business is on the table, the more profit your business is making, the more it’s worth. Maximizing what you can earn from the sale of your business is something a broker can help with, both to ensure your business stays profitable before the sale and is valued correctly to get you the most money possible.

Wondering how much your small business is worth? Try our business valuation calculator tool to get a clear understanding of your company’s potential value. Aniss Cherkaoui gathers all the information needed to value and list your small business for sale, ensuring you are getting the best return on your years of investments.

Some small businesses may try one of these three options or a combination of several (or all) to combat the impact of inflation on their bottom line. Still others may decide the best option for them is to sell.

If selling is something a business is considering, now might be the right time before an additional interest rate hike. The more rates increase, the harder it may be to get a loan, meaning your business may have fewer buyers able to secure funding. Additionally, despite inflation’s current effects, the economy is still growing, meaning you stand to make more of a profit now on the sale of your business than you may in the future. Finally, it may be easier to find a buyer now, should inflation get worse and fewer buyers are willing or able to take on additional debt.

During uncertain times, it helps to have the assistance of a professional broker. Aniss Cherkaoui is here to help facilitate your business sale — especially during a fast-moving market. Schedule a FREE consultation today with Aniss Cherkaoui to get started.

Jul

Thinking of Selling Your Beauty or Personal Care Business? What You Need to Know in 2022

How people accessed many personal care experiences changed during the pandemic, but the industry adapted in many ways like by going online with their products or taking a more natural approach. The world has reopened, and beauty-based companies continue to rebound, so you may be asking—is now a good time to sell.

Selling a beauty or personal care business is not very different than selling any type of business. The crux of the process rests on how well your business is competing in the market.

Other issues that can impact the sale of your personal care business, include if you own your location, how many other similar beauty businesses are in your area and what’s the condition of your salon.

Beauty or personal care business include:

- Hair Salons

- Skin Care and Massage

- Tanning Salons

- Makeup Application/Beauty Bar

- Nail Salons

- Day Spas

- Barbershops

- Beauty Supply Store

- Body and Ear Piercing

- Waxing and Hair Removal

- Brows and Lashes

At Transworld Business Advisors, we’ve had years of experience selling a range of beauty businesses. In fact, the personal care industry historically has been Transworld’s second highest segment of businesses sold.

Despite a minor pandemic-related dip, the industry has been rebounding nicely. Much of the credit for this comeback goes toward the resurgence of weddings, events, and travel as people have clamored to reconnect with friends and loved ones.

There is no doubt that people are eager to get back to normal. What’s more, they also want to feel better about themselves, both inside and out, which is fueling the need for businesses centered on beauty and self-care.

- There’s tremendous room for growth in the beauty industry. If you’ve been concerned that the market is over-saturated, never fear. Year after year, the personal care industry has shown high margins and recurring purchase patterns. The key has been in the industry’s ability to change with its consumers.

- Location is everything. The old saying is true. A variety of factors come into play in terms of location and what will make your business attractive to a buyer. For instance, what kind of foot and/or road traffic does your location receive? Is it hard to get to? Is parking a challenge?

Whether you own or lease your space also matters. The traditional model is you own a beauty business, and you hire talent to work there. You pay them and handle all bookings. Another option are beauty businesses that rent spots to individuals who then handle their own clientele and income. The final type of beauty business is suite based. In this example, you own a large area that contains small rooms that are then rented out to different beauty-focused businesses. These individuals pay rent and are responsible for their own insurance.

The distinctions matter because if you lease your premises, whoever buys your business will be assigned the lease and takeover rent payments. However, if you own the space, then you have a choice to make. You can retain ownership of the building and lease it to a new purchaser, or you can include the building within your sale.

What’s the physical condition of your space? This is a final factor that influences how easily your beauty business will sell. You’ll want to do an honest appraisal of your assets. Are all your permits in order? Do you have a great staff already in place? Is your equipment current and in good working order? What is the appearance and general aesthetic of the space? Finally, cleanliness and health standards are more important than ever. Having all these factors in place and up to date will make your business more appealing to buyers.

Steps to Selling Your Beauty Company

There are many reasons why you’ve come to the decision to sell your beauty business. Transworld can help.

- Accurately valuing your business. This is important because you want the best price for your years of hard work and effort. It also matters to help fuel your next adventure, whether that’s a new business or simply taking some time for yourself and your family. Transworld has a FREE business valuation calculator tool that can help you start on the path of selling your beauty business.

- Get your assets and financials in order. This process will include reviewing all inventory and equipment, cash flow, profits, and revenue, and assessing other assets like reputation, customers, and branding.

- Find the right broker to sell your business. Aniss Cherkaoui has years of experience brokering the sale of businesses, and he's here to make the transition simple for you.

Contact Aniss Cherkaoui to schedule a FREE consultation today to get started.

May

Thinking of Selling Your Construction Business? What You Need to Know in 2022

After a bit of a tough turn during the pandemic, the construction industry has come roaring back to life. Demand is growing, with an increase of almost 9% anticipated for 2022 for this industry segment within the U.S. market.

While supply chain disruptions and shortages of skilled workers may be continuing to cause hiccups for some, the overall outlook is very positive, particularly in terms of infrastructure.

If the thought of selling your construction business has ever crossed your mind but you’ve never been entirely sure if it was the right time, now may be your moment. You’ve worked hard to build a successful construction business, so why not reap the rewards?

The time is now to turn a profit from the sale of your construction business.

The successful sale of a construction company can be similar in many ways to any other company. You need your financial records in order, a loyal workforce and to show an increase in profitability. But construction does have some unique characteristics that may present a demanding opportunity.

You need someone who knows how to handle any challenges that arise. In 2021, construction was the second highest sold business for Transworld Business Advisors. The construction industry can be cyclical, as we’ve seen at the start of the pandemic, which is why you should strike while the iron is hot. And the iron is definitely hot at this very moment.

Check out the three must-haves we believe will make your construction company a hot commodity in the current market.

- Personnel. Like other industries, construction companies have to deal with their fair share of personnel and labor issues. Now is no exception. Businesses that possess an experienced staff set a business apart and can attract buyers. Why? Because a skilled workforce means less training and work for your buyer. It also indicates that your construction business already has effective training and safety programs in place. Be sure you have all your safety records and proper labor documentation in place to demonstrate this.

- Equipment. On par with a stable and well-trained workforce is possessing quality construction equipment. It is no secret the construction market has been hit with supply chain issues during the past few years. You can stand out from your competition if you can offer a buyer equipment that’s in good shape. Well-maintained equipment and facilities can even boost your asking price.

- Pipeline. Finally, a construction business that has built a solid pipeline of project opportunities has a leg up in the market. This demonstrates how well your business operates, as does having evidence of good cash flow and a record of on-time payments. Add to that a history of enforcing good safety protocols, adhering to OSHA requirements, and having the proper insurances and licensing in place, and your construction business will present an appealing opportunity to any buyer.

Steps to Selling Your Construction Company

There are many players in the business of construction. This means the construction sector can be a crowded one. If you have maintained your business well, your construction company can be in high demand, if you are thinking of selling. Good records and upkeep are essential.

All signs point to now offering a great opportunity to make your exit. However, because the construction industry is subject to ups and downs, you want to seize your moment. The safest and quickest way to sell your construction business begins with a conversation with Aniss Cherkaoui.

I am trained as a business broker, meaning I have all the expertise you need to help protect you and your business throughout the process.

Contact Aniss Cherkaoui to schedule a FREE consultation today to get started.

What You’ll Learn on This Blog

How to Sell a Business in Florida: Pricing, timing, negotiation, and the full selling process.

Business Valuation & SDE Analysis:

How Florida businesses are valued using SDE, EBITDA, comparable sales, and market multiples.

Florida Market Trends:

Local insights covering Miami-Dade, Broward, Palm Beach, Naples, Orlando, and surrounding areas.

Buyer Expectations & Due Diligence:

What buyers look for and how to prepare your business for a smooth transition.

Industry-Specific Valuation Guides:

HVAC, engineering, landscaping, childcare, healthcare, trades, services, and more.

Real Transaction Insights:

Practical lessons and takeaways from successful business sales across Florida.

Where We Work — and What We Know

This blog includes insights and valuation guidance for business owners in:

-

Miami-Dade County: Miami, Coral Gables, Doral, Kendall, Brickell

-

Broward County: Fort Lauderdale, Weston, Plantation, Hollywood, Pembroke Pines

-

Palm Beach County: Boca Raton, West Palm Beach, Delray Beach, Jupiter

-

Collier County: Naples, Marco Island

-

Orange County: Orlando and nearby areas

Explore the latest insights to help you prepare your Florida business for a successful sale.