How to Value an Engineering Firm in Florida

(Civil, Structural & Beyond)

A Guide to Business Owners and Buyers

If you're thinking about selling or acquiring a civil or structural engineering firm in Florida, understanding how to properly value the business is critical. These firms are not like typical service businesses; they depend on technical credentials, strong client relationships, and predictable revenue streams, particularly from long-term contracts with municipalities, developers, or public infrastructure agencies. According to IBISWorld NAICS 237990, approximately 63% of industry revenue originates from local and state government contracts, reinforcing the importance of public-sector relationships in this sector. In this guide, we explore how buyers, lenders, and advisors determine value, and what makes an engineering business more attractive in the eyes of the market.

Why Valuing Engineering Firms Requires Industry-Specific Knowledge

Engineering firms offer specialized services that require professional licensure and are subject to strict industry regulations. Because of this, valuing these businesses goes beyond just reviewing financials, it also requires a deep understanding of the firm’s internal operations, licensing structure, and the dynamics of the engineering industry:

-

Diverse Client Portfolio

Firms that serve both public (e.g., municipalities) and private (e.g., developers, architects) clients typically earn higher multiples. -

Revenue Backlog & Active Contracts

A backlog of signed projects creates stability and justifies stronger valuations. -

Owner Involvement

The less the seller engages in day-to-day technical or project work, the more transferable and valuable the firm becomes. -

PE Licensing & Credentialed Staff

A Florida firm with active Professional Engineers (PEs) on staff is worth significantly more, as buyers must either hold PE licensure or employ credentialed staff to meet regulatory requirements.

Case Studies:

How Two Florida Engineering Firms Attracted the Right Buyers

In two cases, I facilitated the successful sale of both a civil engineering firm and a structural engineering firm in Florida, each representing a distinct type of buyer.

- The civil engineering firm was acquired by a licensed civil engineer who relocated to Fort Lauderdale, Florida. The business had been operating for over a decade, serving both municipalities and private clients, and the sale included the office real estate as part of the transaction.

- The structural engineering firm was acquired by a strategic buyer looking to expand into Florida. Its long-standing commercial relationships and strong management team made it a highly attractive acquisition target.

Key Value Drivers Included:

-

- PE-licensed professionals on staff: Having one or more licensed engineers employed at the firm significantly increases its value, as buyers must either already hold the required licenses or hire qualified individuals to meet Florida’s regulatory requirements

- Long-standing relationships with municipalities and private developers

- Recurring revenue and multi-year project history

- Technical staff committed to remaining post-sale

These transactions reflect two distinct buyer profiles common in this space: individual operators seeking relocation and strategic buyers expanding regionally.

Valuation Multiples for Engineering Businesses in Florida

In Florida, valuation multiples for engineering firms typically range from 2–4x SDE for smaller businesses, while larger firms with over $5 million in revenue and strong recurring contracts may command EBITDA multiples as high as 6x

Industry Benchmarks and Operating Metrics (NAICS 237990)

- Annual Growth (2020–2025): 0.3%

- Projected Growth (2025–2030): 1.2%

- Average Profit Margin: 6.7%

- Revenue per Employee: $342,954

- Top Project Types: Mass transit (43%), conservation/development (19%), recreation facilities (15%)

- Primary Clients: 63% local/state government, 32% private sector

What Buyers Want to See

Buyers of engineering firms, especially strategic acquirers, and SBA-funded individual buyers—often look for:

- Clean, adjusted financials with accurate job costing

- Multi-year client history and project case studies

- Opportunities to grow backlog or cross-sell services

- Team stability, including licensed engineers and drafters

- A management team or second-in-command to step in post-sale

Deal Financing and Timing

-

SBA Financing:

Often covers up to 90% of the deal with favorable terms for businesses with real estate -

Down Payment:

Typically, 10%–20%, depending on cash flow strength -

Deal Timeline:

Most engineering firms take 9-14 months to close from listing to funding

Florida-Specific Factors to Keep in Mind

-

Licensing:

In Florida, engineering work often requires site-specific certifications and an active PE (Professional Engineer) license held by an individual. Because PE licenses cannot be transferred to a new owner, it’s critical that the buyer already holds the required license, or retains licensed staff, to ensure operational continuity.Real Estate:

Including office space in the deal enhances SBA financing options and reduces buyer hesitationState and County Contracts:

These create recurring revenue and are often key valuation multipliers.

Common Red Flags That Lower Value

- Business dependent on one or two large clients

- Owner is the only licensed engineer or heavily involved in design work

- Weak recordkeeping or unclear revenue backlog

- No defined growth plan or marketing strategy

Closing Thoughts: How to Maximize Your Firm’s Value

The best way to prepare your Florida engineering firm for sale is to view it through a buyer’s lens. Focus on documentation, licensure continuity, and reducing owner dependency. If possible, secure signed contracts or backlog before listing the business.

Whether planning a sale in six months or three years, taking these steps early can dramatically increase your company’s marketability and value.

Need a Valuation or Exit Strategy?

Request a Free Valuation or speak to Aniss Cherkaoui P.A., an experienced business advisor with Transworld Business Advisors, with multiple successful closed transactions in engineering and construction-related M&A across Florida.

Sources:

- DealStats (2025), Business Valuation Resources

- IBISWorld NAICS 237990 Report (Heavy Engineering Construction)

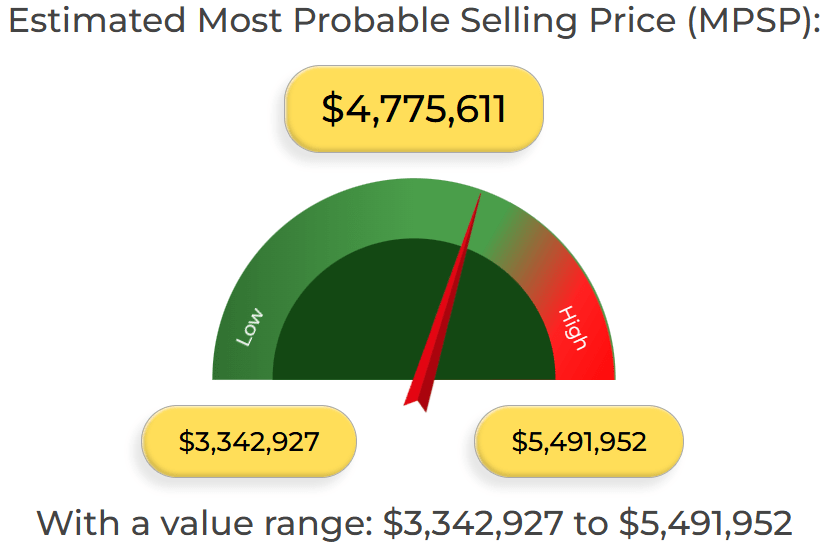

Free Business Valuation Calculator Results

Get an accurate, data-backed valuation estimate in seconds. This is a sample of the valuation range you’ll see after using our calculator:

Why Business Owners Trust my Calculator:

-

1Instant Business Valuation Range No waiting get your estimated business value right away.

-

2Data-Driven Accuracy Calculations are based on thousands of real private business sales and market insights.

-

3Built for Owners Ready to Sell Whether you’re planning an exit, seeking investors, or just curious, this tool gives you a realistic snapshot of your business’s current value.

Call Today to Speak with a Broker 305-608-6761

You might want to see

How to Value a Roofing Company in Florida

How to Value an Electrical Company in South Florida