Inflation has changed the numbers for many Florida business owners. Rising labor costs, higher insurance premiums, and ongoing operating expenses are putting pressure on profits. As a result, more owners are choosing to sell their business in Florida sooner than planned, while others are waiting and hoping conditions improve.

Across South Florida, business sales activity has increased as owners reassess their timelines. But deciding when to sell is rarely straightforward. The right answer depends on your financials, your personal goals, and where your business is headed.

If you own a business in Broward, Miami-Dade, or Palm Beach County and are wondering whether now is the right time to sell, this guide will help you think through the decision clearly and realistically.

Why More Business Owners in South Florida Are Selling

Several factors are pushing owners to speak with a business broker in Florida right now.

-

Margin pressure

Inflation hits small and mid-sized businesses quickly. Payroll is up. Rent, insurance, and vendor costs continue to rise. Many Florida business owners can’t raise prices fast enough to offset these increases, which leads to shrinking margins and concerns about long-term value.

-

Owner fatigue

The last few years have been demanding. From pandemic disruptions to hiring challenges and now inflation, many owners are simply worn out. Even profitable businesses in Miami, Broward, and Palm Beach are being sold because owners are ready for relief from the constant pressure.

-

Active buyer demand

Despite economic uncertainty, buyers are still actively searching for businesses for sale in South Florida. SBA financing remains available, and qualified buyers are motivated. Well-run businesses with clean financials continue to attract serious interest.

-

Retirement timing

Many owners are approaching retirement and don’t want to keep postponing personal plans. Waiting often means working longer without a guarantee of a better outcome.

How Inflation Affects Business Valuations in Florida

Inflation can affect business value in different ways.

Challenges

Buyers focus on cash flow. When expenses rise faster than revenue, valuations can soften. Increased uncertainty leads to stricter due diligence and tougher negotiations. Higher operating costs can also increase working capital requirements at closing.

Opportunities

Some Florida businesses are benefiting from strong local demand and higher revenue. Real estate and equipment may have appreciated. Owners who have successfully adjusted pricing and protected margins demonstrate stability and pricing power, which buyers value.

Signs It May Be Time to Sell Your Business in Florida

Selling now may make sense if:

- 1 Profit margins are declining, with limited ability to recover

- 2 You’re experiencing burnout or loss of motivation

- 3 You’re nearing retirement and want to reduce risk

- 4 The business is performing well right now

- 5 The business needs capital or energy, but you’re no longer willing to invest

- 6 Personal priorities or health circumstances have changed

Selling while the business is still strong often leads to better results than waiting for performance to decline.

When Waiting Could Be the Better Option

Waiting may be the right move if:

- 1 Recent underperformance is temporary

- 2 You see clear opportunities to increase value

- 3 You’re not personally ready for a sale

- 4 Your industry is likely to rebound

- 5 Financial pressure is not driving your decision

- 6 A family member or key employee may eventually take over

If time is on your side, improving profitability and reducing owner dependence can significantly increase value.

Preparing to Sell a Business in Broward, Miami, or Palm Beach

Whether you plan to sell now or later, preparation matters.

If you’re considering selling soon

- Ensure financial statements are accurate and organized

- Reduce owner dependence

- Document systems and processes

- Address obvious operational issues

- Speak with a South Florida business broker early

If you plan to wait

- Focus on improving margins and cash flow

- Strengthen management and delegation

- Make investments that increase long-term value

- Monitor buyer demand and market conditions

- Avoid unnecessary risks that could hurt future value

Making the Right Decision

There is no universal answer. Selling a business is both a financial and personal decision.

Ask yourself:

-

What are my long-term goals?

-

Is the business improving or becoming harder to manage?

-

Do I still have the energy to grow it?

-

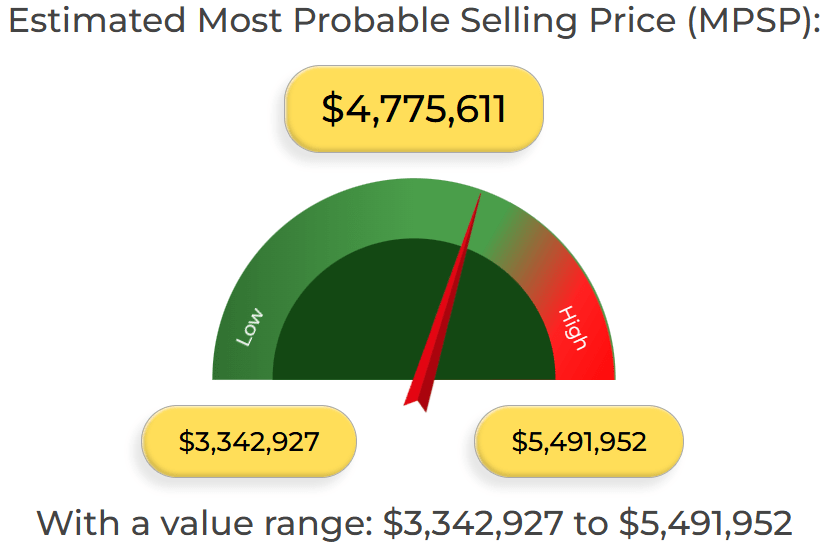

What is my business realistically worth in today’s Florida market?

-

Are buyers actively looking for businesses like mine?

Getting objective guidance helps. A conversation with an experienced Florida business broker can provide clarity, realistic pricing expectations, and insight into current buyer demand.

Final Thoughts

Inflation is pushing many Florida business owners to rethink their timelines. Some are choosing to sell now to lock in value while buyer demand remains strong. Others are waiting, confident they can improve performance over time.

Neither choice is automatically right or wrong. What matters most is making an informed decision based on facts, not fear or speculation.

If you’re thinking about selling a business in Broward, Miami-Dade, or Palm Beach County, now is the time to understand your options.

Call or Contact Me

If you’d like to know what your business is worth or whether now is the right time to sell, call or contact me directly for a confidential conversation.

Aniss Cherkaoui, P.A.

Business Broker with Transworld Business Advisors

I work with business owners throughout Broward, Miami-Dade, and Palm Beach County, providing confidential business valuations, market insight, and guidance through every step of the sale process.

No pressure. Just clear answers and honest advice.

Contact me or call 305-608-6761 to get started.