10 Mistakes to Avoid When Selling Your Small Business | Aniss Cherkaoui P.A., Transworld Business Brokers

Senior Business Advisor | Transworld Business Brokers

Selling your business is one of the most important decisions you’ll ever make. It’s not just a financial transaction; it’s the end of one chapter and the beginning of another. Whether you're retiring, starting a new venture, or simply ready to move on, how you approach the sale can make all the difference.

After more than 20 years in the business brokerage industry, I’ve seen what works and what doesn’t. Below are ten common mistakes that business owners make when selling and how to avoid them.

1. Pricing Based on Emotion, Not Market Value

It’s natural to be attached to your business. But buyers don’t pay for your personal investment; they pay for the earnings, assets, and future potential.

What to do:

Get a professional valuation based on real financials and current market data. This helps set a price that attracts serious buyers and stands up to scrutiny.

2. Incomplete or Disorganized Financial Records

Buyers need to see clear, accurate financials. If your records are messy or incomplete, the deal will likely stall or fall apart entirely.

What to do:

Prepare at least three years of profit and loss statements, tax returns, bank statements, and contracts. If your records need work, get help early in the process.

3. Failing to Prepare the Business for Sale

A business with unresolved issues or outdated systems won’t show well. Buyers want something that runs smoothly from day one.

What to do:

Address legal issues, clean-up operations, review lease terms, and consider small improvements that could make a strong first impression.

4. Slowing Down Operations During the Sale

Some owners mentally check out once the business is listed. But declining performance can hurt your valuation and scare off buyers.

What to do:

Stay focused. Maintain strong operations and steady revenue to keep your business looking like a worthwhile investment.

5. Not Having a Clear Exit Plan

Without a plan for what comes next, you may hesitate at key moments or even back out of a solid deal.

What to do:

Take time to map out your goals post-sale. Whether it’s retiring, starting another business, or taking time off, knowing what’s next gives you clarity.

6. Sharing the News Too Early

Telling staff, customers, or vendors too soon can create uncertainty and weaken your position.

What to do:

Keep the sale confidential until it's appropriate to disclose. A professional advisor can manage the process quietly and protect your business's stability.

7. Engaging with Unqualified Buyers

Not everyone who shows interest is a serious buyer. Some don’t have the financial ability or relevant experience to close the deal.

What to do:

Screen buyers before sharing sensitive information. Look for proof of funds, relevant background, and motivation to complete a transaction.

8. Getting Too Emotional During Negotiations

Selling a business can be personal but letting emotions take over can lead to poor decisions or missed opportunities.

What to do:

Stay focused on your goals. Treat the sale as a business deal and lean on your advisors to help navigate challenging conversations.

9. Rejecting Creative Deal Structures

Insisting on an all-cash offer can limit your buyer pool. Many deals include flexible terms that still protect the seller.

What to do:

Be open to structures like seller financing or earnouts, as long as they align with your goals and minimize your risk.

10. Trying to Sell Without Professional Help

Selling a business is complex. Going it alone often leads to undervaluation, poor negotiation, or deals falling through.

What to do:

Work with experienced professionals who can guide you through every step, from valuation and marketing to due diligence and closing.

Thinking About Selling?

If you're considering selling, whether now or in the future, the best time to start planning is today. With the right strategy and experienced guidance, you can maximize your outcome and move forward with confidence.

Schedule a confidential consultation with me at Tnational.com

Let’s talk about your goals, your timeline, and what success looks like for you.

Related Resources:

- How to Prepare Financials for a Business Sale

- Free Business Valuation Guide

- Do You Need an Attorney to Sell a Business?

- Seller Financing: What You Need to Know

About the Broker

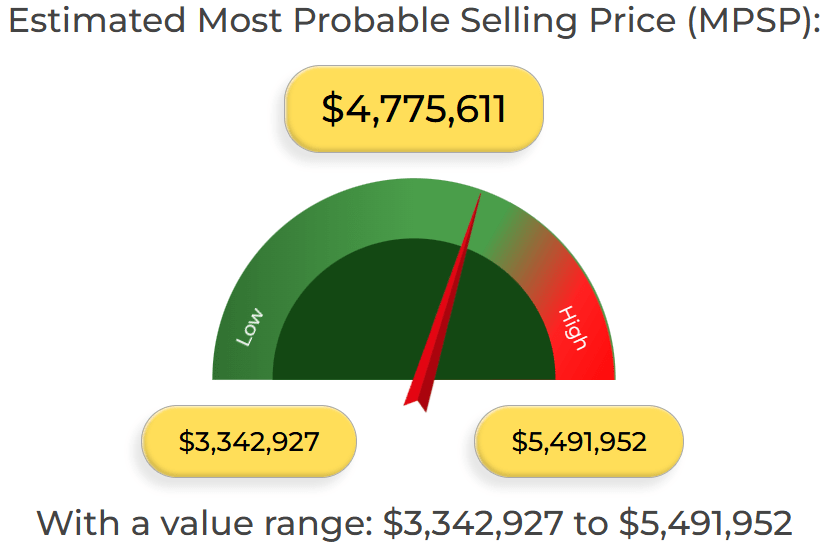

Free Business Valuation Calculator Results

Get an accurate, data-backed valuation estimate in seconds. This is a sample of the valuation range you’ll see after using our calculator:

Why Business Owners Trust my Calculator:

-

1Instant Business Valuation Range No waiting get your estimated business value right away.

-

2Data-Driven Accuracy Calculations are based on thousands of real private business sales and market insights.

-

3Built for Owners Ready to Sell Whether you’re planning an exit, seeking investors, or just curious, this tool gives you a realistic snapshot of your business’s current value.

Call Today to Speak with a Broker 305-608-6761

You might want to see

Business Valuation Calculator - Real Comps & Florida Broker Support (MPSP Alternative to CalcXML)

How to Value an Electrical Company in South Florida