Do You Really Need a Lawyer to Sell Your Business?

Insights from Aniss Cherkaoui, P.A., Senior Business Advisor Transworld Business Brokers

Selling a business is one of the most significant financial and personal decisions an owner can make. It’s not just about finding a buyer it’s about navigating a complex process involving contracts, regulations, taxes, and liabilities.

While it’s technically possible to sell without a lawyer, doing so is a risk most owners shouldn’t take. Over my 20 years advising sellers across Florida, I’ve seen deals succeed because they had the right legal protection and I’ve seen others collapse without it.

This guide explains why legal guidance matters, how attorneys work alongside business brokers, and what documents and details they handle to protect your sale.

Why Legal Guidance Is Worth It

There’s no law requiring you to hire an attorney to sell your business. But in practice, legal oversight can mean the difference between a smooth, profitable transaction and an expensive problem.

Selling a business often involves:

A single missed clause, wrong date, or unfulfilled filing can delay closing or reduce your proceeds. An experienced attorney ensures that documents are accurate, agreements are enforceable, and the deal complies with all applicable laws.

How Attorneys and Brokers Work Together

As your broker, I manage the sale from a strategic perspective, confidential marketing, screening buyers, guiding negotiations, and keeping the process on track. Your attorney focuses entirely on protecting your legal interests. A business sale attorney will:

When the broker and attorney work as a team, sellers get both deal-making expertise and legal protection.

State Rules You Can’t Overlook

Every state has its own laws governing business sales. Missing even one requirement can jeopardize your transaction.

Examples include:

Public notice laws: Some states require you to notify creditors before the sale.

Creditor protection rules: Debts must be disclosed and satisfied in specific ways.

License transfers: Industry licenses may need reapplication or approval.

Regulatory compliance: Labor laws, tax filings, and environmental standards vary by state.

If your company is in a regulated field such as healthcare, food service, or childcare, legal guidance is especially critical.

Structuring the Deal for Tax Efficiency

One of the smartest reasons to hire an attorney is to structure the sale in a way that minimizes taxes. Working with your CPA, your attorney can determine whether an asset sale or stock sale offers the best after-tax result.

Get this wrong, and you could face a higher tax bill, or even an IRS issue, after closing. The right structure can protect your profit and keep you compliant.

Key Documents That Require Legal Oversight

An attorney will prepare, review, or finalize the documents that define your sale, including:

Each of these has a direct impact on your legal rights and financial outcome.

Can You Sell Without a Lawyer?

Yes, but it’s risky. Without legal help, sellers often face:

What looks like a cost-saving shortcut can end up costing far more than hiring an attorney from the start.

Choosing the Right Business Sale Attorney

Not all attorneys have the right background for this work. Look for someone who:

-

- Specializes in mergers, acquisitions, or business transactions

- Communicates clearly and responds quickly

- Works well with your broker and CPA

- Has a proven record of successful closings

My Role in Your Sale

When I represent you, I help assemble the right team from day one, attorney, CPA, and other professionals to ensure your transaction runs smoothly.

I make sure:

Selling a business is too important to leave to chance. With the right team, you can protect your interests and maximize your outcome.

Related Articles

- 10 Mistakes to Avoid When Selling a Small Business

- How to Price Your Business for Sale

- The Pros and Cons of Seller Financing

About the Author

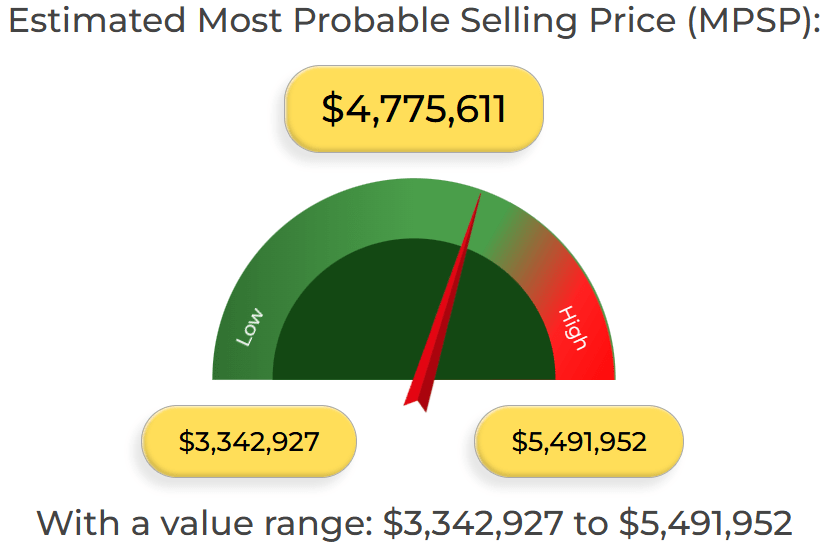

Free Business Valuation Calculator Results

Get an accurate, data-backed valuation estimate in seconds. This is a sample of the valuation range you’ll see after using our calculator:

Why Business Owners Trust my Calculator:

-

1Instant Business Valuation Range No waiting get your estimated business value right away.

-

2Data-Driven Accuracy Calculations are based on thousands of real private business sales and market insights.

-

3Built for Owners Ready to Sell Whether you’re planning an exit, seeking investors, or just curious, this tool gives you a realistic snapshot of your business’s current value.

Call Today to Speak with a Broker 305-608-6761

You might want to see

Business Valuation Calculator - Real Comps & Florida Broker Support (MPSP Alternative to CalcXML)

How to Value an Electrical Company in South Florida