By Aniss Cherkaoui, P.A.

Senior Business Advisor | Transworld Business Brokers

Selling your business is nothing like selling a car or a house. This is one of the most significant financial moments of your life, filled with emotions, high stakes, and more moving parts than most people realize.

Some owners look at broker commissions and think, Why not just handle this myself? On paper, it sounds simple: find a buyer, agree on a price, sign the paperwork. In reality, the process is a maze of valuation challenges, legal traps, buyer tactics, and timing decisions that can make or break your outcome.

Over the years, I have seen sellers walk away with deals that exceeded expectations. I have also seen others lose hundreds of thousands of dollars because they went it alone.

Here’s what really happens when you sell without a broker: the benefits, the risks, and the “I wish I knew that before” moments.

Why Some Sellers Go Solo

1

Saving on Commissions

This is the most common reason I hear. Many owners ask, “Why pay someone a percentage of my sale price when I can do it myself?” Skipping the commission is tempting. However, if a broker could bring you a significantly higher price through competitive bidding, that fee might feel like a smart investment instead of a cost.

2

Full Control

Some owners want to make every decision themselves, from who they speak with to how the deal is structured. While control can be appealing, it also means taking on every responsibility and every potential problem.

3

Already Having a Buyer

If your buyer is a friend, competitor, or employee, hiring a broker can feel unnecessary. But relationships can quickly become strained when business and money mix. Having a neutral party can preserve both the deal and the relationship.

4

Thinking It’s a Small, Simple Sale

Small sales can hide big problems. Issues with leases, unpaid taxes, licenses, or liens can appear when you least expect them.

The Risks Nobody Talks About

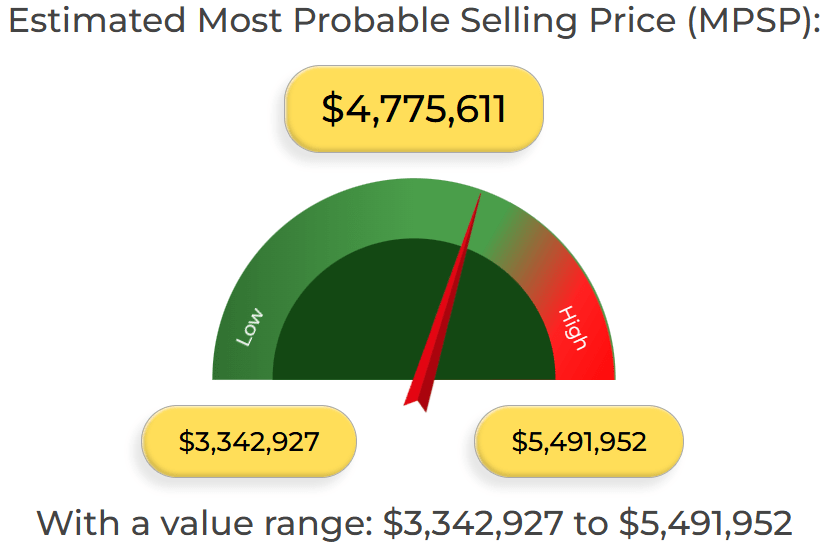

Pricing Blind Spots

Owners often misprice their business. Setting the price too high can drive away buyers, while setting it too low leaves money on the table. Accurate pricing requires market insight, knowledge of buyer behavior, and an understanding of timing.

Limited Buyer Reach

Selling on your own usually means you will reach a small group of contacts or online inquiries. Brokers can discreetly market to hundreds of qualified buyers without exposing your business to the public.

Legal and Due Diligence Gaps

One poorly written contract clause or incomplete NDA can undo months of work. Due diligence is not just a formality; it is critical to protecting your interests.

Time Drain

While you are answering buyer questions and chasing paperwork, your business performance can suffer. Declining numbers during the sale process can scare off buyers.

Emotional Decisions

It is hard to stay objective when selling a business you built. Emotions can lead to rejecting strong offers or accepting weak ones for the wrong reasons.

What You Will Handle Without a Broker

If you go solo, be prepared to:

-

- Maintain three to five years of financial statements, normalized P&Ls, and supporting documents.

- Market the business confidentially without alarming staff, customers, or competitors.

- Screen buyers for financial capacity, industry fit, and commitment.

- Negotiate price, terms, and structure while staying objective.

- Coordinate with your CPA, attorney, escrow agent, and lender, each working on different timelines.

- Protect confidentiality at all times, since one leak can damage your business.

Why Many Sellers Choose a Broker

💡

Valuation Expertise

Brokers base pricing on solid data, industry trends, and real-world deal experience, not guesswork.

🤝

Larger, Qualified Buyer Pool

Brokers have access to networks of serious buyers and know how to create competition for your business.

📝

Negotiation Strength

Brokers focus on facts and solutions. They know how to handle sticking points without letting emotions get in the way.

📅

Time and Energy Back

You keep running your business while the broker handles the deal. This helps preserve value and reduces stress.

The Bottom Line

1

Can you sell without a broker?

↓

2

Will you get the highest price, clean terms, and minimal stress?

↓

That is far less certain.

Selling your business is often the final chapter in your ownership journey. Make it a chapter you can look back on with pride, knowing you achieved the best possible outcome.

Ready to Talk About Selling Your Business?

Selling a business is one of the most important financial decisions you’ll ever make. The right strategy can mean the difference between a good deal and the best deal.

If you’re thinking about selling or just want to understand your options, let’s talk. I offer confidential consultations where we’ll review your goals, your business’s market value, and the strategies that can help you achieve the best outcome.

Call Aniss Cherkaoui, P.A.

Senior Business Advisor, Transworld Business Brokers

Phone: 305-608-6761

Email: aniss@tworld.com

About the Broker

Aniss Cherkaoui, P.A. is a seasoned M&A advisor with over two decades of experience and more than 100 completed transactions across a wide range of industries in Florida. He has worked as a business broker and advisor since 2004 and joined Transworld Business Brokers in 2014. Aniss continues to help business owners throughout Palm Beach, Broward, Miami-Dade, and beyond navigate the sale of their companies with confidence, clarity, and discretion.

He has been recognized by the Business Brokers of Florida as a Top Volume Producer and honored by the International Business Brokers Association with the Platinum Chairman’s Circle Award, a distinction reserved for the nation’s top-performing business brokers.