Frequently Asked Questions

Is this really free?

Yes there’s no cost or commitment. We believe in empowering business owners with tools that help them make informed decisions.

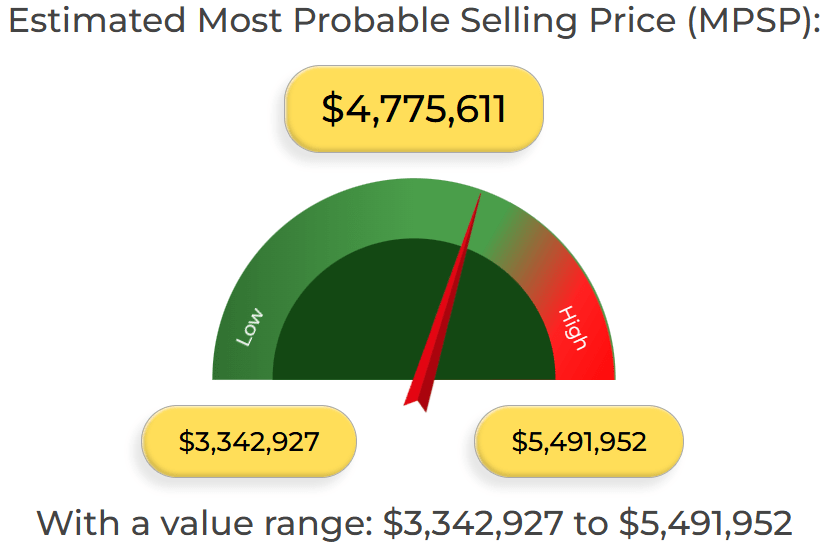

How do I know this estimate is accurate?

Your estimate is backed by years of actual deal data and evaluated using our MPSP methodology. While it’s not a formal appraisal, it offers more precision than generic online calculators.

What happens after I get my valuation?

After reviewing your results, you can choose to connect with Aniss Cherkaoui for a personalized consultation. He’ll walk you through next steps, buyer targeting strategies, and market timing.

Can I use this for SBA loans or legal proceedings?

This tool provides a general estimate and is not intended for legal, financial, or tax use. For formal valuations, we offer certified appraisal services through our trusted partners.

Why Do You Need a Business Valuation?

A business valuation is often necessary for several reasons, whether you are seeking financing, planning a sale, or assessing your financial strategy. Here are some common reasons:

Litigation

Legal situations like divorce settlements, partnership disputes, damage claims, or shareholder disputes often require a formal business valuation. Litigation outcomes can significantly impact the business's value and future earnings.

Future Planning

A business valuation provides owners with insights into factors that drive growth, profitability, and efficiency, enabling informed decision-making and strategic planning. These insights can help in optimizing operations or expanding into new markets.

Tax and Succession Planning

Valuations help estimate estate taxes, gift tax responsibilities, and prepare for retirement. They align with IRS guidelines by providing an accurate assessment of value, ensuring compliance and proper documentation for tax purposes. Valuations also support smooth succession planning.

Sales, Mergers, and Financing

Valuations are essential for negotiations involving sales, purchases, or mergers. They provide a basis for determining fair pricing and offer negotiation leverage to ensure favorable outcomes. Valuations also serve as benchmarks for partner buy-ins, shareholder buy-outs, and financing from lenders. Employee stock ownership plans often rely on valuations for establishment and management.

Insurance Coverage

Valuations help determine the appropriate level of insurance coverage needed to protect the company's assets, such as key person insurance or business interruption policies.

Benchmarking Performance

Regular valuations allow owners to track the company's performance, identify strengths and weaknesses, set goals, and make adjustments to improve profitability. For example, metrics such as revenue growth rate, profit margins, and return on assets can be monitored to evaluate progress.

What Makes a Business Valuable to Buyers?

The value of a business is fundamentally determined by two key elements: the potential return on investment (ROI) and the associated risk level. Buyers tend to pay more for businesses that promise strong ROI and minimal risk. For instance, a well-established e-commerce store with diversified revenue streams and a loyal customer base is perceived as having high ROI potential and low risk. To enhance your business's value, it is essential to minimize uncertainties and demonstrate stability. Here are some main attributes that increase a business’s appeal and value to potential buyers:

- Businesses that offer financing options are more attractive, as these options make acquisition more feasible and decrease perceived risks.

- Accurate financial records and well-maintained books, ensuring transparency and financial health.

- Predictable key drivers of new sales and revenue.

- Consistent or increasing customer traffic from diverse marketing channels.

- Strong relationships with reliable suppliers, including backup options for added security.

- High percentage of repeat sales, reflecting strong customer satisfaction and brand loyalty.

- Clean legal record, free from disputes or liabilities.

- Effective brand protection, free of trademark, copyright, or legal issues.

- Well-documented systems and processes, such as standard operating procedures (SOPs), to ensure smooth and consistent operations.

- Clear evidence of growth potential, indicating scalability opportunities for future expansion.

These characteristics signal to buyers that the business is structured for success with minimal risks, thereby directly enhancing its market value.