About Aniss Cherkaoui, P.A.

M&A Advisor • Business Valuation Strategist • Transaction

Specialist

For more than two decades, I have helped business owners understand their true market value and navigate the sale of their companies with clarity, confidentiality, and a structured, professional approach. I specialize in bringing order and direction to what is often the largest financial decision an owner will make, ensuring every step of the process is grounded in accurate valuation, disciplined preparation, and steady communication.

While my work spans businesses across Florida, I specialize in advising owners throughout Miami-Dade, Broward, and Palm Beach counties.

Professional Background and Perspective

My career began in senior operational and sales leadership within a Fortune-level organization, where I spent seventeen years managing teams, complex projects, and high-stakes client relationships. These experiences sharpened my ability to think clearly under pressure and manage sensitive situations—skills that translate directly into the advisory work I do today.

I later joined Amerivest Business Brokers, where I became a top producer across multiple sectors. In 2014, I joined Transworld Business Advisors, the world’s largest business brokerage network. This platform provides extensive buyer reach, established processes, and global visibility while allowing me to offer personalized, hands-on guidance to every client.

As a former business owner myself, I understand the emotional weight of planning an exit and the importance of protecting the team, culture, and legacy you’ve built.

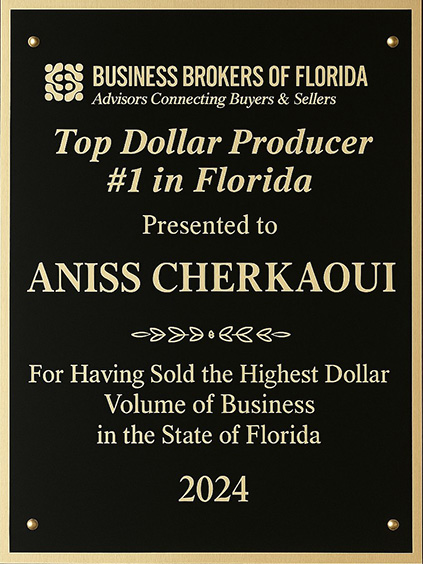

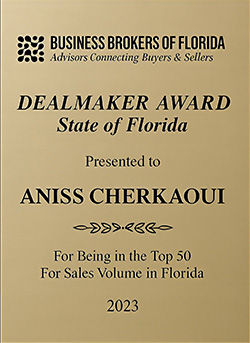

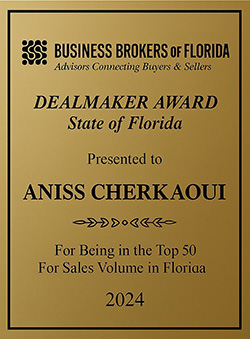

Awards & Recognition

My work has been recognized by leading industry organizations for performance, deal volume, and professional standards.

Business Brokers of Florida (BBF)

- Top Producer (multiple years)

- Dollar Volume Leader (multiple years)

International Business Brokers Association (IBBA)

- Platinum Performer

- Member in Good Standing

Transworld Business Advisors

- Recognized for valuation accuracy

- High closing ratios

- Strong deal structure performance

- Consistent client satisfaction

Top Producer and Dollar-Volume Leader

Platinum Level Producer

These distinctions reflect a long-term commitment to accuracy, preparation, and ethical advisory work.

Experience Across 100+ Business Sales

I have completed more than one hundred business sales across a wide range of industries, including trades, logistics, healthcare, retail, hospitality, professional services, and technology-enabled companies. My work spans both main-street and lower middle-market transactions and includes:

This background allows me to anticipate challenges early, communicate effectively with all parties,

and guide owners through a process that protects momentum and minimizes disruption.

Owners considering a future exit can also review the full Selling Process to understand how valuation connects to structure and negotiation.

A Valuation-First Approach to Selling a Business

A successful exit begins with knowing what the business is truly worth—not an assumption, not a guess, and not a broker’s opinion, but a market-supported valuation based on comparable sales, adjusted earnings, and current buyer demand. My advisory process starts with a detailed review of financials, systems, staff structure, risk factors, and operational strengths. From there, we build a strategy that allows buyers, lenders, and advisors to see the business the way you do.

Owners receive clear answers to essential questions:

What is the company worth based on real transactions?

How will buyers and lenders evaluate cash flow and risk?

What improvements meaningfully increase value?

How should the business be prepared for due diligence?

This clarity sets the tone for a smoother negotiation and a well-managed closing.

A Structured Process for a Clean, Confident Exit

Selling a business requires more than marketing—it requires structure. My approach includes:

-

Clear, market-based valuation

-

Professional documentation and preparation

-

Controlled and confidential buyer outreach

-

Financial verification and buyer screening

-

Thoughtful negotiation of terms and structure

-

Guidance through due diligence, lending, and closing

Every stage is designed to protect the business, reduce uncertainty, and help owners exit on their terms.

A Commitment to Owners

My mission is simple: to help entrepreneurs protect the value they have built and make informed, confident decisions about their future. Through clear communication, structured preparation, and experienced negotiation, I guide owners through a process that honors their investment of time, money, effort and positions them for a strong, well-managed exit.

Your personalized valuation and selling strategy begin here.

If you’re exploring timing or preparing for a transition, you can start with a confidential Business Valuation Review

or request a direct consultation through the Contact Page.

ABOUT TRANSWORLD BUSINESS ADVISORS

Transworld Business Advisors is the world’s largest business brokerage network, built on more than four decades of experience in confidential business sales, franchise consulting, and mergers and acquisitions. With offices across the United States and in more than a dozen countries, Transworld provides an unmatched platform for connecting qualified buyers and sellers in every major industry.

As a licensed agent and advisor within this network, I combine Transworld’s global reach with the hands-on, valuation-driven approach that my clients expect. This partnership gives business owners access to:

- The largest active buyer pool in the industry

- A global marketing platform reaching domestic and international investors

- Proprietary valuation tools and market data

- A structured transaction process refined over 40+ years

- Specialized M&A support for larger or more complex engagements

Transworld’s reputation for integrity, confidentiality, and consistent deal execution strengthens

every engagement I manage. When paired with my valuation-first process and one-on-one advisory

approach, clients receive a level of service that blends personalized guidance with the resources

and infrastructure of an international organization.

Together, this creates a powerful advantage for owners seeking a clean, well-managed,

value-maximized exit.

For Florida-based owners, regional guidance is available through dedicated pages for

Miami,

Broward,

Palm Beach.

Let’s Talk About Your Next Move

Whether you're ready to sell or simply exploring your options, a confidential conversation can give you clarity, direction, and a realistic sense of value.

You built your company with years of hard work and commitment. My role is to help you protect that value and exit with confidence and clarity.