Separate personal and business expenses now

How to Calculate Seller’s Discretionary Earnings (SDE) And Why It Can Make or Break Your Business Sale

Senior Business Advisor | Transworld Business Brokers

Selling your business isn’t just about finding a buyer and agreeing on a number, it’s about proving your value in a way that buyers, lenders, and investors will respect. For small to mid-sized, owner-operated companies, the single most important number in that process is your Seller’s Discretionary Earnings (SDE).

SDE is the gold-standard metric buyers use to answer the question: “How much can I make if I own and operate this business?” It’s the number that drives your asking price, your negotiating leverage, and often whether your deal gets financed or falls apart.

In this guide, you’ll learn exactly what SDE is, how to calculate it, what counts as an add-back, and why a clean, well-documented SDE can mean the difference between multiple offers and months of frustration. If you want to know your number right now, try our Business Valuation Calculator or see What Is My Business Worth? for a deeper dive.

What Is Seller’s Discretionary Earnings?

Seller’s Discretionary Earnings represent the total financial benefit a full-time owner/operator gets from a business in one year. It starts with net profit, then adds back expenses that are not essential for a new owner, such as your own salary, personal perks, and one-time costs.

Other terms you might hear for SDE include Adjusted Cash Flow, Owner’s Benefit, or Recast Earnings. They all mean the same thing: showing the full earning power of the business for someone stepping into your role.

Example: What SDE Looks Like in Real Life

Let’s say you own an HVAC company with these numbers:

SDE Calculation:

That means a buyer could reasonably expect $360,000 in annual owner benefit.

Pro Tip: Most businesses sell for a multiple of SDE. If your industry average multiple is 3×, your business could sell for around $1.08M. You can get a Most Probable Selling Price range here.

Why SDE Matters for Your Sale Price

If similar HVAC businesses in your area sell for 3× SDE, your estimated market value could be:

$360,000 × 3 = $1,080,000 asking price.

But here’s where sellers often get blindsided:

If your books are messy or your add-backs aren’t well-documented, lenders may refuse to finance the deal. That leaves you chasing all-cash buyers, which is rare for million-dollar businesses. Buyers with that much cash usually target larger, higher-return companies.

A business broker can help clean up your SDE before you hit the market, making it easier for SBA lenders to say “yes” and for buyers to see your business’s full value.

For tips on boosting your numbers and buyer appeal, see Increase the Value of Your Business Before You Sell or How to Make Your Business Highly Sellable in Florida.

How to Calculate Your SDE Step-by-Step

Start with Net Profit (or Pre-Tax Income)

Found at the bottom of your Profit & Loss (P&L) statement.

Add Back One Full-Time Owner’s Compensation

If multiple owners work in the business, only add back one salary unless the new owner won’t need to replace the others.

Add Back Standard Non-Cash or Financing Costs:

- Depreciation

- Amortization

- Interest Expense

- Owner Payroll Taxes

Add Back Discretionary Expenses

Personal or non-essential costs such as:

- Club memberships

- Personal travel

- Charitable donations

- Owner’s cell phone or personal vehicle

Add Back One-Time/Non-Recurring Expenses

Examples: emergency repairs, legal settlements, unusual tech purchases.

Subtract Non-Operating Income

Anything unrelated to ongoing operations:

- Asset sales

- Unrelated rental income

- Insurance payouts

Common Add-Back Guidelines

Clearly Acceptable:

Gray Area (Needs Justification):

Not Acceptable:

SDE vs. EBITDA Which Should You Use?

SDE:

EBITDA:

Why a Clean SDE Sells Better

A well-documented SDE builds buyer trust, supports higher valuations, and increases the odds of lender approval. If you wait until you’re ready to sell to fix your books, it may already be too late to optimize your price.Pro Tips to Boost Your SDE Before Selling

Work with a broker early for pre-sale positioning

Keep clean, CPA-reviewed financials

Document every legitimate add-back clearly

Avoid “gray area” deductions in the year or two before selling

Clean books = more buyers = higher offers. For more on financial prep, see Increase the Value of Your Business Before You Sell.

Ready to See Your SDE in Action?

Knowing your SDE is step one in understanding what your business is worth today.

Use our Free Business Valuation Calculator to get your most probable selling price range in minutes.

About the Broker

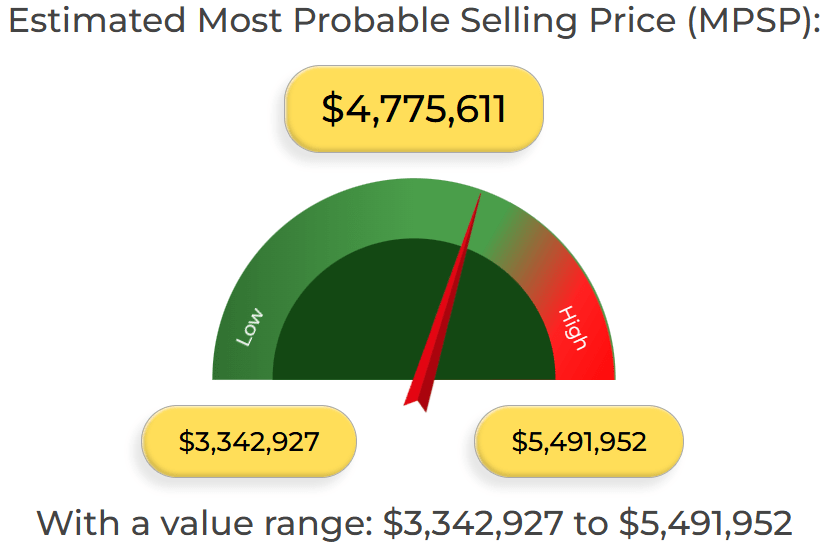

Free Business Valuation Calculator Results

Get an accurate, data-backed valuation estimate in seconds. This is a sample of the valuation range you’ll see after using our calculator:

Why Business Owners Trust my Calculator:

-

1Instant Business Valuation Range No waiting get your estimated business value right away.

-

2Data-Driven Accuracy Calculations are based on thousands of real private business sales and market insights.

-

3Built for Owners Ready to Sell Whether you’re planning an exit, seeking investors, or just curious, this tool gives you a realistic snapshot of your business’s current value.

Call Today to Speak with a Broker 305-608-6761

You might want to see

Business Valuation Calculator - Real Comps & Florida Broker Support (MPSP Alternative to CalcXML)

How to Value an Electrical Company in South Florida