Top Business Broker in Tampa | Tips + Market Insights

Serving Broward, Palm Beach, Miami & Beyond | By Aniss Cherkaoui P.A.

Sell Your Business in Florida with Confidence

Whether you're selling a $500K HVAC company or a $25M engineering firm, great exits don’t happen by chance. They happen with planning, precision, and the right advisor.

This no-fluff guide walks Florida business owners through how the sale process works, what a business broker does, and why working with an experienced expert like me, Aniss Cherkaoui P.A. of Transworld, makes all the difference.

Thinking About Selling Your Business in Florida?

Florida’s market is hot. Whether you're on the Gulf Coast, Atlantic Coast, or anywhere in between, you’re in one of the most active M&A regions in the country.

Buyers are everywhere: retirees, private equity firms, strategic acquirers, even international investors. That means more opportunity, but also more noise.

That’s where I come in. I’m Aniss Cherkaoui P.A., a seasoned business broker with Transworld Business Advisors. I help business owners across Florida—from Fort Lauderdale to Tampa to Jacksonville—exit with strategy, structure, and serious results.

Step 1: Clarify Your Exit Goals (Not Just Your Price)

Before we talk numbers, we talk vision:

-

1Do you want to retire fully?

-

2Keep some equity?

-

3Sell to a partner or family member?

We reverse-engineer your strategy based on your goals.

Step 2: Know What Your Business Is Really Worth

We don’t guess. We calculate:

- Recasted financials

- Normalized earnings and add-backs

- Local and national comps

- SBA financeability and buyer demand

Online valuation tools can give you a rough idea, but they’re only a starting point. Most rely on outdated formulas or generic multipliers and don’t account for Florida-specific dynamics, industry shifts, or buyer behavior.

My calculator is better than most, but even that is just a preview. The real valuation? That takes a conversation.

To know what your business is truly worth, we need to talk. The best valuations are custom, not canned.

We use real-world comps, private databases, and insights from live buyer activity in your sector. Then we add experience, the part no algorithm can replicate.

The result? A price buyers respect, not reject. And that gets you to the closing table faster, with more money in hand.

Step 3: Understand Who Will Buy Your Business

Florida’s buyer pool is incredibly diverse

- First-time entrepreneurs relocating to Florida

- Strategic buyers expanding regionally

- Latin American investors entering the U.S. market

- Private equity firms rolling up verticals

We tailor outreach for each type.

Understanding Buyer Types: Who’s Actually Acquiring Businesses?

The four main buyer types I regularly deal with:

-

Strategic Buyers

In your industry, looking to grow fast. -

Financial Buyers

Investment-focused firms seeking growth and ROI.

(Private Equity) -

Family Offices

Long-term buyers representing wealthy families. -

Individual Buyers

Often SBA-backed, hands-on operators.

Knowing your ideal buyer type helps us market smarter and close faster.

Step 4: Prep the Business, Not Just the Books

What we clean up together:

- 1Financial statements

- 2Vendor and customer contracts

- 3State and local licensing

- 4Key employee roles

In Florida, licensing and compliance issues can delay deals. We get ahead of them early.

Step 5: Build Your Deal Team

You’ll need:

- 1A CPA with deal experience

- 2A business-savvy attorney

- 3A Florida-based broker (me)

I act as the quarterback and keep the team moving.

Step 6: Market Confidentially and Strategically

My marketing approach isn’t “list and hope.” I map out a tailored strategy based on your goals. This includes:

- 1Collaborating on messaging and positioning

- 2Targeted outreach through Transworld’s 1000+ global advisors

- 3Active networking with M&A professionals and buyer groups

- 4Listing on exclusive business-for-sale platforms

- 5Email campaigns and buyer database alerts

Every step is designed to quietly attract serious buyers, not just tire kickers.

Your business isn't listed like real estate. We:

- Write a compelling, blind teaser

- Pre-qualify buyer interest

- Use Transworld’s global reach

- Tap private buyer networks and investor platforms

Your team and competitors never know the business is for sale.

First Comes the Teaser: A Quiet Introduction

We start with a teaser, a short, anonymous profile introducing your business without disclosing your identity. We only share more after buyers sign a confidentiality agreement (NDA).

This protects your privacy and filters out the noise.

What’s in a Great CIM, and Why It Matters

The CIM (Confidential Information Memorandum) is a 30–70 pages document telling your story clearly and strategically.

It includes:

This is not just a brochure. It’s your marketing weapon to attract top offers.

Step 7: Screen Buyers Like TSA

We check:

- 1Liquidity

- 2Licensing and location fit

- 3Operational ability

- 4Reputation

I don’t let unqualified buyers waste your time.

Step 8: Negotiate Terms, Not Just Price

I help you negotiate:

- 1Deal structure

- 2Transition plan

- 3Asset versus stock sale (and tax impact)

The price is just one line. Structure is where value lives.

Step 9: Manage Due Diligence Like a Pro

I prepare everything so buyers move quickly:

- Licenses, leases, tax returns, and payroll

- Financial reports and add-backs

- Buyer and lender requests

Momentum matters. I keep the deal alive through diligence.

How Long Does the M&A Process Take?

-

-

Prep and pricing

4-6 weeks -

Marketing

2-3 months (or less) -

Buyer negotiations

4 weeks -

LOI and Due Diligence

8-12 weeks -

Closing and Transition

2-12 weeks

-

It’s not overnight, but I guide you from the first meeting to the final wire.

Who Does the Heavy Lifting? (Hint: Not You)

What I handle:

- 1Valuation, pricing, and market prep

- 2Writing the teaser and CIM

- 3Screening buyers and managing NDAs

- 4Negotiating offers and deal terms

- 5Running due diligence

- 6Communicating with all advisors

What you provide:

- Key documents

- Business insights

- Decision-making

You keep running your business. I’ll run your deal.

Before That: From CIM to LOI — How Buyers Submit Offers

Once serious buyers engage, we initiate a structured process:

- CIM shared → Process Letter issued

- Buyers submit IOIs (Indications of Interest)

- We narrow to top prospects and arrange management calls or site visits

- LOI (Letter of Intent) negotiations begin

The LOI defines the purchase price, payment structure, and key deal terms. It’s non-binding, except for confidentiality and exclusivity.

Why You Want a Closer on Your Side

I stay close to every step, from attorneys to CPAs to insurance reps to the buyer’s team, so nothing slips through the cracks.

Deals fall apart when no one leads. I lead.

I coordinate with everyone involved: your attorney, CPA, internal managers, the buyer’s team, SBA lenders, and insurance agents. That means fewer bottlenecks and no last-minute surprises. My job is to keep the deal moving forward, no matter how many moving parts.

Step 10: Close the Deal and Protect the Transition

After the wire hits, it’s about:

- Transition training

- Client and employee announcements

- Ownership, account, and vendor handoffs

A good deal ends in a wire. A great deal ends in a handshake.

Broker Compensation: What You Pay For, and Why It’s Worth It

Business brokers aren’t magicians. We’re advisors, negotiators, marketers, and project managers rolled into one. If you’ve ever thought, “A broker just finds a buyer and collects a check,” let me clarify what actually happens behind the scenes.

For smaller business transactions—typically under $2 million—brokers usually charge a success fee ranging from 10% to 12% of the sale price. For mid-market deals, I apply a modified Lehman formula, which reduces commission rates at incremental tiers as deal size increases. Once transactions enter the M&A space ($10 million and above), fees become more flexible and are negotiated based on complexity, deal timeline, and buyer profile.

Here’s what you’re paying for:

- 1Accurate valuation to attract the right buyers

- 2Confidential marketing that doesn’t expose your staff or clients

- 3Qualifying buyers to avoid timewasters

- 4Managing attorneys, CPAs, and banks during diligence

- 5Keeping the deal alive when challenges emerge

A great broker doesn’t “sell” your business. They engineer the outcome.

I do the heavy lifting so you can keep running your company, right up to closing day.

Florida Market Snapshot

Areas I Serve:

Miami, Fort Lauderdale, Palm Beach, Tampa, Orlando, Jacksonville, Naples ...and beyond

Industries I’ve Helped Sell:

-

HVAC and construction trades

-

Clinics and healthcare services

-

Daycares and private schools

-

Auto repair and marine

-

E-commerce and logistics

-

Engineering and consulting firms

If it cash flows and has value, I can sell it.

Let’s Talk, Confidentially

If you're considering a sale or just want to understand your options, let’s talk. I’ll walk you through what to expect and help you see what your business might really be worth.

All discussions are confidential.

Written by Aniss Cherkaoui P.A.

Florida Business Broker & M&A Advisor

Transworld Business Advisors

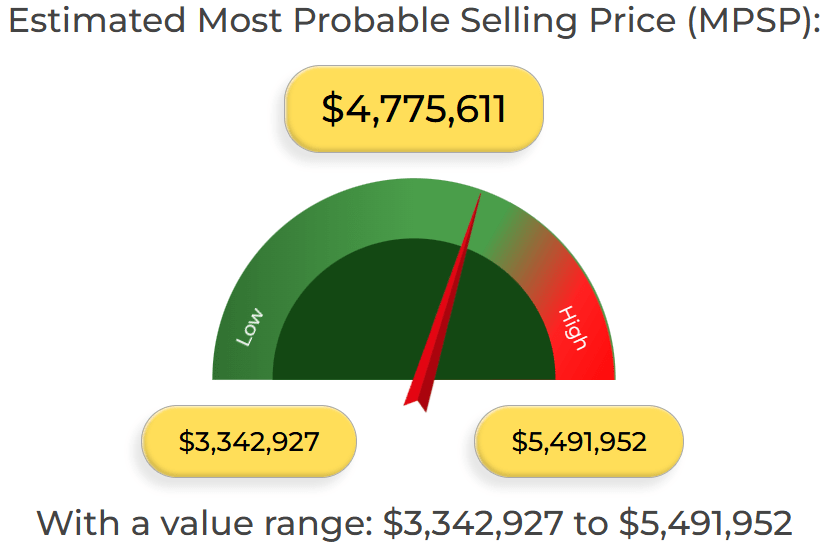

Free Business Valuation Calculator Results

Get an accurate, data-backed valuation estimate in seconds. This is a sample of the valuation range you’ll see after using our calculator:

Why Business Owners Trust my Calculator:

-

1Instant Business Valuation Range No waiting get your estimated business value right away.

-

2Data-Driven Accuracy Calculations are based on thousands of real private business sales and market insights.

-

3Built for Owners Ready to Sell Whether you’re planning an exit, seeking investors, or just curious, this tool gives you a realistic snapshot of your business’s current value.

Call Today to Speak with a Broker 305-608-6761

You might want to see

How to Value a Roofing Company in Florida

How to Value an Electrical Company in South Florida