How to Value a Roofing Company in Florida

If you own a roofing business in Florida and you're thinking about selling, preparing for retirement, or simply want to understand your company's market value, you’re in the right place.

Valuing a roofing company isn’t just about multiplying profit. Buyers consider structure, team, risk, and long-term sustainability. Florida’s roofing market has unique trends that affect value and if your business is well-positioned, it could be worth significantly more than you expect.

Let’s break down how roofing companies are valued, what buyers are looking for, and how you can estimate your business’s value using a trusted tool.

Real Deal: $30 Million Roofing Company Sale

In a recent Florida transaction I managed, the seller owned a well-established roofing company with strong earnings, experienced crews, and clean financials. The buyer was a strategic acquirer in the HVAC industry looking to expand into complementary trades. The final sale price? Nearly $30 million.

The deal was structured to include:

- An earn-out tied to revenue and margin goals

- An employment agreement that retained the seller for transition, licensing, and sales continuity

- An emphasis on preserving team structure and reputation

This is a prime example of how strategic value, not just financials, can drive a premium sale.

What’s Driving Roofing Business Value in 2025

The Florida roofing market is hot, and buyers are actively looking for scalable, well-run companies. Key value drivers include:

- Re-roofing demand Over 80% of industry revenue comes from re-roofing, driven by aging homes and repeat storm damage.

- Extreme weather events Florida’s climate ensures ongoing demand for emergency repairs and insurance-funded replacements.

- Labor shortages Companies with trained W-2 crews and low turnover are significantly more attractive to buyers.

- Industry consolidation Private equity and strategic buyers are actively acquiring roofing companies to grow market share.

Industry Benchmarks (IBISWorld, 2025)

- Average profit margin: 7.7%

- Revenue per employee: $260,081

- Average SBA loan: $394,115

- Average down payment: 62%

- Average time to sell: 423 days

These benchmarks help set expectations, but your business’s systems, staff, and client mix will drive your actual valuation.

Valuation Methods Buyers Use

-

1SDE (Seller’s Discretionary Earnings) This method is most common for small to mid-sized businesses. It calculates your total owner benefit, including net profit, salary, and discretionary expenses. Most roofing companies under $10M in revenue are valued using an SDE multiple.

Typical range in Florida: 2.5x to 4.0x SDE

Strong leadership, licensing, and profitability push the multiple higher. -

2EBITDA (For Larger Companies) If your roofing business earns over $1M in EBITDA, it may attract private equity or larger strategic buyers. Valuation range: 4x to 6x EBITDA

-

3Asset Consideration Vehicles, trailers, and tools add value, but earnings and systems remain the foundation for serious buyers.

What Buyers Want and What They Avoid

Buyers look for:- Consistent earnings and year-over-year growth

- Documented job backlog and pipeline

- Loyal crews and safety compliance

- Transferable licenses and clean books

- Digital systems for quoting, job tracking, and communication

- Owner-reliant businesses

- Cash-heavy or poorly documented financials

- Lack of licensing or HR structure

- High turnover or low margins

Use the Business Valuation Calculator

If you're ready to get a directional estimate of your company’s worth, start with our business valuation calculator. It's fast, confidential, and built specifically for Florida business owners who want clarity before making big decisions.

You’ll receive a preliminary valuation range based on your earnings and business profile, along with the opportunity to speak directly with me, Aniss Cherkaoui, for deeper guidance.

Ready to Take the Next Step?

Whether you’re based in Miami, Fort Lauderdale, West Palm Beach, or anywhere in Florida, the smartest exits begin with real insight. The calculator gives you a starting point; a confidential consultation gives you a plan.

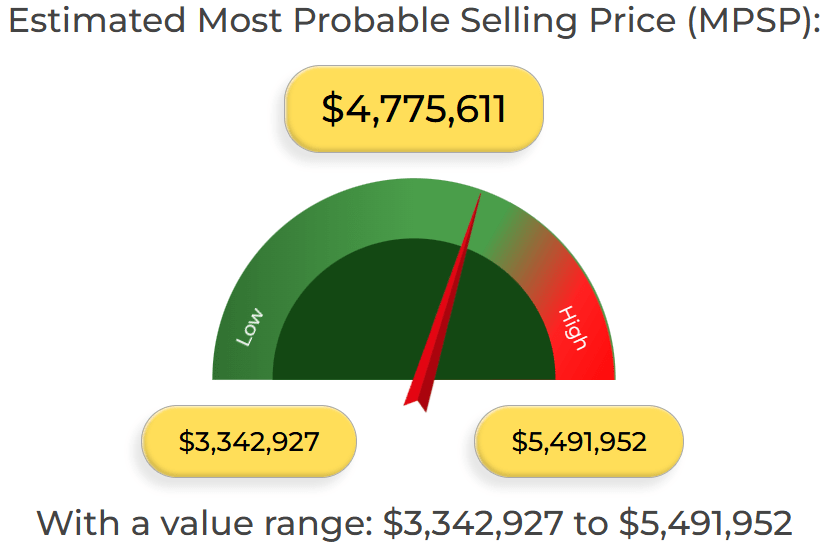

Free Business Valuation Calculator Results

Get an accurate, data-backed valuation estimate in seconds. This is a sample of the valuation range you’ll see after using our calculator:

Why Business Owners Trust my Calculator:

-

1Instant Business Valuation Range No waiting get your estimated business value right away.

-

2Data-Driven Accuracy Calculations are based on thousands of real private business sales and market insights.

-

3Built for Owners Ready to Sell Whether you’re planning an exit, seeking investors, or just curious, this tool gives you a realistic snapshot of your business’s current value.

Call Today to Speak with a Broker - 305-608-3761

You might want to see

How to Value an HVAC Company in Florida

How to Value an Electrical Company in South Florida